It's not a secret:

Chart patterns are effective tools for traders to find profitable opportunities in the market.

Although several patterns exist, some patterns are more popular and tend to carry a higher probability of success than other patterns. The following four patterns fall into this category as they are widely known among experienced traders.

1. The Head and Shoulders Pattern

The head and shoulders pattern signals a reversal of trend. There are two variations of the pattern, offering trading opportunities both to the long and short side. The bearish version is referred to as a head and shoulders pattern while the bullish version is called an inverted head and shoulders pattern.

In the example of VMWare (VMW), an inverted head and shoulders pattern took place on a daily chart in late 2015 to early 2016.

There are four key points to note in identifying the pattern. The left shoulder, head, rights shoulder and neckline. Symmetry is important in this particular pattern and a general rule of thumb is that the better the symmetry, the higher the probability of the pattern playing out.

Let's explain:

In assessing symmetry, the low of the left shoulder should be similar or very close in price to the low of the right shoulder. The neckline should be a fairly straight horizontal line but a slight slant is acceptable. There are some examples where the neckline carries an angle or the two shoulders don’t align perfectly, but the theory behind the pattern is that the better the symmetry the more traders are likely to have spotted it, increasing the probability of the pattern playing out.

Trade With Head and Shoulders Pattern

In trading the head and shoulders or inverted head and shoulders pattern, traders wait for a sustained break of the neckline.

Where do we see it?

In the example of VMW, a break of the neckline came in the form of a gap up after the company reported better than expected earnings in July 2016. Often price will retest the neckline to offer a good entry point, however, with VMW the momentum created by the earnings report triggered a steady flow of buying that caused the stock to move straight to the target without retesting the neckline.

The target for a head and shoulders pattern is derived by taking a measurement from the head of the pattern to the neckline and then looking for an equal distance measured move starting from the neckline. A simple method in making this calculation is by drawing a line on a stock chart from the head to the neckline and then cloning that line and moving it to the neckline at the point of breakout, as illustrated in the above chart. The VMW head and shoulders pattern called for a target of roughly $84 which was reached in early 2017.

It is important for price to stay above the neckline once the pattern is activated. A sustained break back below it would invalidate the pattern.

2. The Flag Pattern

The flag pattern also comes in two varieties, a bullish and bearish variant named appropriately as a bull flag and bear flag. Unlike the head and shoulders pattern, however, this pattern looks for a continuation of trend.

The flag pattern is straightforward and easy to verify. It requires two lines with the same angle to be drawn around price action. There should be at least two points of contact for the highs and the low.

The example below shows a flag pattern that started in early August 2017 and took about a month to play out:

The Goldman Sachs flag pattern was drawn by connecting the high posted in early August with a high posted at the start of September. That line can then be cloned and pasted at the lows to create a channel. Actually, most charting platforms will have a channel tool, eliminating the need to clone trendlines.

Target For a Flag Pattern

The trading signal from the pattern comes following a sustained break of the upper bound of the channel in the example of the bullish variant.

In this case, there was a retest of the upper line which offers a good entry. Like all chart patterns, a retest is common but does necessarily always occur.

The target for a flag pattern is derived at by measuring the length of the bullish leg that proceeds the pattern and calculating an equal length from the point where the upper line of the pattern was breached. In the above example, similar to how a target was derived with the prior head and shoulders pattern, the method of cloning trendline was used.

Once an upside break occurs in a bullish flag pattern, price should remain above the upper line on a sustained basis. Traders will often enter with a stop below the last swing low, indicated by the red line in the above example. A sustained break back within the channel warrants closing the trade ahead of the stop as it suggests a weak pattern that is not likely to play out.

3. The Triangle Pattern

The triangle pattern is similar to the flag pattern as traders look for a technical break to signal a continuation of trend. The differentiating factor is that within a triangle, the trendlines converge.

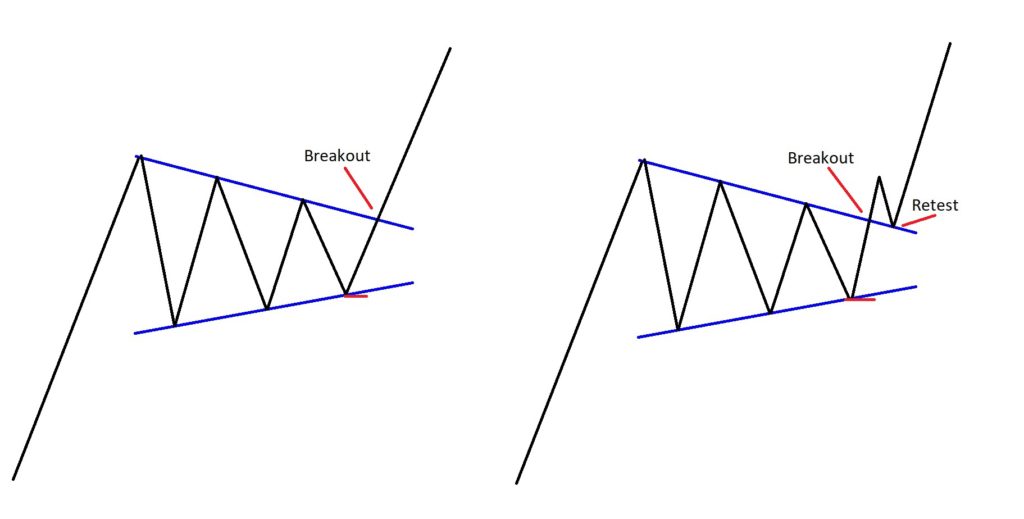

As with most patterns, there may or may not be a retest although the former is quite common. The above is an example of both scenarios.

Usually, there will be about three tests of both the upper and lower line, although the minimum is for two points of contact for each line. It is not uncommon for the very last decline in a bullish variant to fall slightly short of testing the rising trendline, as seen in the below example.

Traders will look for a sustained upside break to enter and will often place a stop below the prior swing low, marked in red in the above example. A sustained drop back within the triangle suggests a weak pattern and warrants closing the trade ahead of the stop.

Similar to the flag pattern, an equal legs measurement can be taken to derive at the target for the pattern.

4. The Double Top and Double Bottom

Double tops and double bottoms call for a turn of the trend. They often occur around important technical levels which create a big barrier, causing a reversal of trend or at least a correction. The main characteristic of this pattern is a minimum of two failed attempts at a level followed by a technical break in the opposite direction.

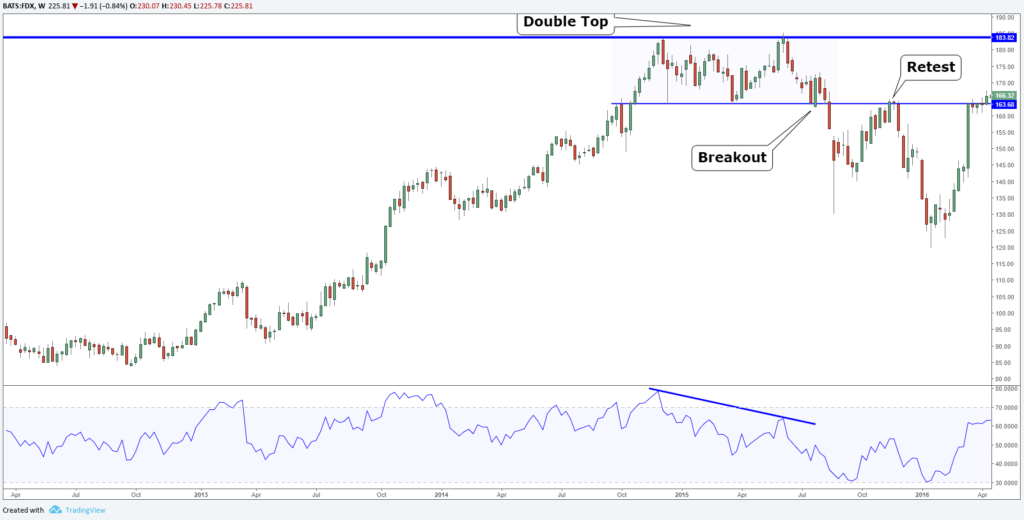

In the above example, FDX struggled at around the $184 price point in late 2014 and the first half of 2015. However, buyers stepped in to support dips towards the $164 price point. Eventually, there was a downside break of $164 in August 2015, confirming that a double top is in play.

In the above example, there was a retest of the breakdown point, offering a second opportunity to get involved in the trade for those that missed it the first time around.

Daily Double Top w RSI

Using a combination of tools can help the trader in assessing how likely it is for the pattern to play out. As an example, in the FDX double top, adding a momentum indicator such as RSI reveals a divergence between momentum and price at the time of the double top.

Another tool that could have been used in the same example is a channel.

As can be seen in the below example, FDX broke lower from a rising channel prior to activating the double top pattern.

Combining tools provides a higher conviction of a turn as several technical indicators align and signal the same thing, increasing the probability of the expected move playing out.

Traders that take advantage of chart patterns tend to be patient, waiting for a nicely formed pattern to be presented and often utilize other technical tools to assess the likelihood of the pattern playing out.

The Smart Investor content is intended to be used and must be used for informational purposes only. We are not an investment advisor and you should NOT rely on this information to make investment decisions.

Opinions are on our own. The information is provided for information only and does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or otherwise transact in any investment including any products or services or an invitation, offer or solicitation to engage in any investment activity.

Editors’ Picks

AUD/USD: Warming up or the RBA

AUD/USD added to the move higher and rose to new two-month peaks near 0.6370 on the back of the soft tone in the US Dollar and rising expectation ahead of the RBA’s interest rate decision.

EUR/USD: Next target comes at 1.0530

EUR/USD traded in an inconclusive fashion amid the equally vacillating development in the Greenback, returning to the sub-1.0500 region following reduced trading conditions in response to the US Presidents’ Day holiday.

Gold resumes the upside around $2,900

Gold prices leave behind Friday's marked pullback and regain some composure, managing to retest the $2,900 region per ounce troy amid the generalised absence of volatility on US Presidents' Day holiday.

RBA expected to deliver first interest rate cut in over four years

The Reserve Bank of Australia will announce its first monetary policy decision of 2025 on Tuesday, and market participants anticipate the Board will cut the benchmark interest rate by 25 basis points.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.