Outlook: The interesting US data today is PPI, which rose unexpectedly in Aug to 1.6% y/y, the highest since April and well over the forecast of 1.2%. Commodities make up less than 25% of the PPI and metals, a central commodity, only about 12%. Still, commodities had soared during August but retreated in September. It will be interesting to see what component drove PPI this time. Also, this is another one of those data points with several variations, including “final demand” and core. But again, the headline tends to rule sentiment.

The consensus forecast is for PPI to come in at 0.3% in Sept for Q3 at 4.2%, with the core at 2.3% y/y from 2.2%. CPI tomorrow is more important and expected to retreat to 3.6% from 3.7%. Core is expected at 4.1%, the lowest since May 2021.

Several Fed officials have made dovish statements lately and that has led to an overall sense that the Fed is dovish. The word is used in headlines across all the mainstream financial press.

But take heed: comments by individual Fed presidents are not a valid indicator of what we have taken to calling “main Fed,” meaning the FOMC and chief Powell, with its horde of smart backroom economists. Each regional president has the full right to express personal opinions. Fed rules do not restrict them in any way. Over the years we have had conflicting opinions from various quarters—remember the formerly dovish Minneapolis Kashkari who then became a solid hawk. To infer from a few comments that main Fed has turned dovish is literally without substance and evidence.

The latest comment is from Atlanta Fed Pres Bostic, who is not a voting member this time. He told the American Bankers Association yesterday that "I actually don't think we need to increase rates anymore." He speaks again today.

This is probably true. As we have shown with various adjusted inflation measures (like the NY Fed “underlying inflation gauge”), inflation has already fallen well under 3% and depending on lags, the key core PCE is on track to show those lovely lowish numbers soon. By soon, we mean within six months, so March. But that last mile is going to be a tough row to hoe. The Fed may not be convinced, and it must be convinced until a little more time has passed and we have data under our belts.

Also as noted before, the Fed cares deeply about its reputation for transparency. It signaled one more hike after the September pause. To steer off that path is going to take some serious tap-dancing from Mr. Powell. And the last minutes out today are not going to contain any of those hints, just the usual data-dependency. In the absence of the much-desired rise in unemployment, it’s hard to see how the Fed can retreat from one more hike, as promised.

It’s a little interesting that San Francisco Pres Daly said the so-called neutral rate, which Fed officials have estimated at 2.5% since before the pandemic, may have risen to 3%. This would be easier to reach, of course. But the minutes will probably not reflect that, alas.

Weirdly, this is somewhat divorced from the bond meltdown, which has its own reasons not entirely dependent on this wrong-headed idea of a newly dovish Fed.

But the dollar is continuing to track the 10-year yield and to hell with any economic data. Everyone struggles to find the reasons for yield to have gone so high and now crashing, but frankly, my dear, we don’t care. Bloomberg writes “It's hard to pinpoint exactly what's driving the move lower, but that's in part because it's hard to know for sure what drove the move higher.”

It’s enough, for the moment, to have captured the sentiment driving FX.

We know the dollar index is a lousy indicator—it’s mostly the euro, anyway—but in the absence of an alternative, we need to look at it with cold eyes. The chart here shows the index is about to reach the bottom B band, normally a form of support, having already broken the linear regression channel line (which is stopped at the high and extended out to the current day by computer magic).

If the B band is decisively broken, we then look to the Fibonacci retracements. This is pure superstition, of course, but so many traders are diehard believers that it often becomes a self-fulfilling prophecy. We are a whisker away from the first line (23%). After that, it’s the 39% line at 104.40 and then the 50% line at 103.41. The stochastic oscillator in the top window but the Schaff indicator, not shown, shows a fair amount of room to go.

So, we are not calling a reversal just yet, but we may be at a tipping point.

Forecast: We are about to enter a battle between those who think the dollar should be toast and those who see only a counter-trend bounce and thus seeking a reasonable place to get long again. In practice, this means a decent place to sell euros. Hand-drawn support and resistance lines might be hideously old-fashioned, but are sometimes remarkably accurate. This time we get euro resistance at 1.0698. This is about 100 points over the 24-hour low. So if you are long euros, a good stop is some 20 points above there.

Tidbit: It is not possible to avoid Israeli war news. Try to looking up anything on the internet and you get hit with it. It seems as though the war is getting a lot more attention and coverage than even the Russian invasion of Ukraine. If so, it’s the “never again” factor.

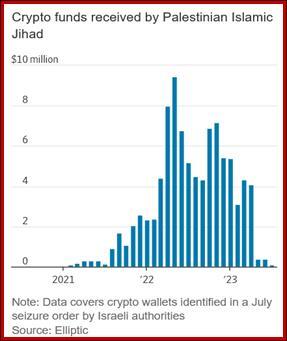

Today the WSJ top story is how Hamas used crypto to finance its war. Other terrorist organizations solicit donations that way, too. Hamas may have raised $41 million that way. See the chart.

So now we know—crypto really is money in the sense that it can be used for transactions. So far it’s money among bad guys—drug cartels, terrorists, arms dealers. You can’t buy a loaf of bread with it. Monitoring crypto transactions and being able to seize wallets is now Task One at treasuries and central banks.

Pres Biden called the Hamas behavior “pure evil.” The EU is steaming mad about misinformation and doctored photos on Twitter/X, no doubt worsened by Musk having gutted the fact checkers team. This could be a test of his cock-eyed idea of freedom of speech. Some folks try to find forecasts for various asset classes and sectors based on the war, already past the savagery and brutality. It’s a little jarring and disgusting. It’s probably true that oil, gold and defense companies will see rising prices because of the war.

Israel has a reputation for the top spot in world-class military intelligence and capability. The intelligence side is accused of falling down on the job this time but there is a good reason for it—Hamas eschewed modern communications and used old-fashioned paper notes and the like, as well as tunnels and housing military stuff inside schools and hospitals. But Israel is now able to call up 300,000 soldiers with a snap of the fingers (while Russia has to use force to get soldiers).

The point is that only a madman would consider starting a war against such an opponent—David vs. Goliath. And yet various Muslim terrorist groups keep doing it. They must be ideology-addled and desperate. The FT has an essay in which the foreign affair expert says “The lesson of the past four decades is also that every attempt to wipe out Palestinian armed groups has only produced more extreme iterations and worse conundrums.”

“At its core, the current conflict is about the longest occupation in modern history, one that leaves the Palestinians dispossessed while Israel quests relentlessly for its security. But the bigger picture is one of regional shifts and global alliances reaching a critical juncture. The danger now is of more strategic blunders that will only perpetuate the violence for years to come.”

Some say this means diplomatic means are the only way out, albeit with a hint that the “occupation” is somehow unjustified. Israel is unwilling to work with butchers. We wonder if it doesn’t mean better Indian reservations.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.