- Genesis Global Capital recently announced it could potentially file for bankruptcy due to an FTX-induced liquidity crunch.

- Despite fears of contagion, one of Asia's biggest crypto lenders, Matrixport, is aiming at a $1.5 billion valuation.

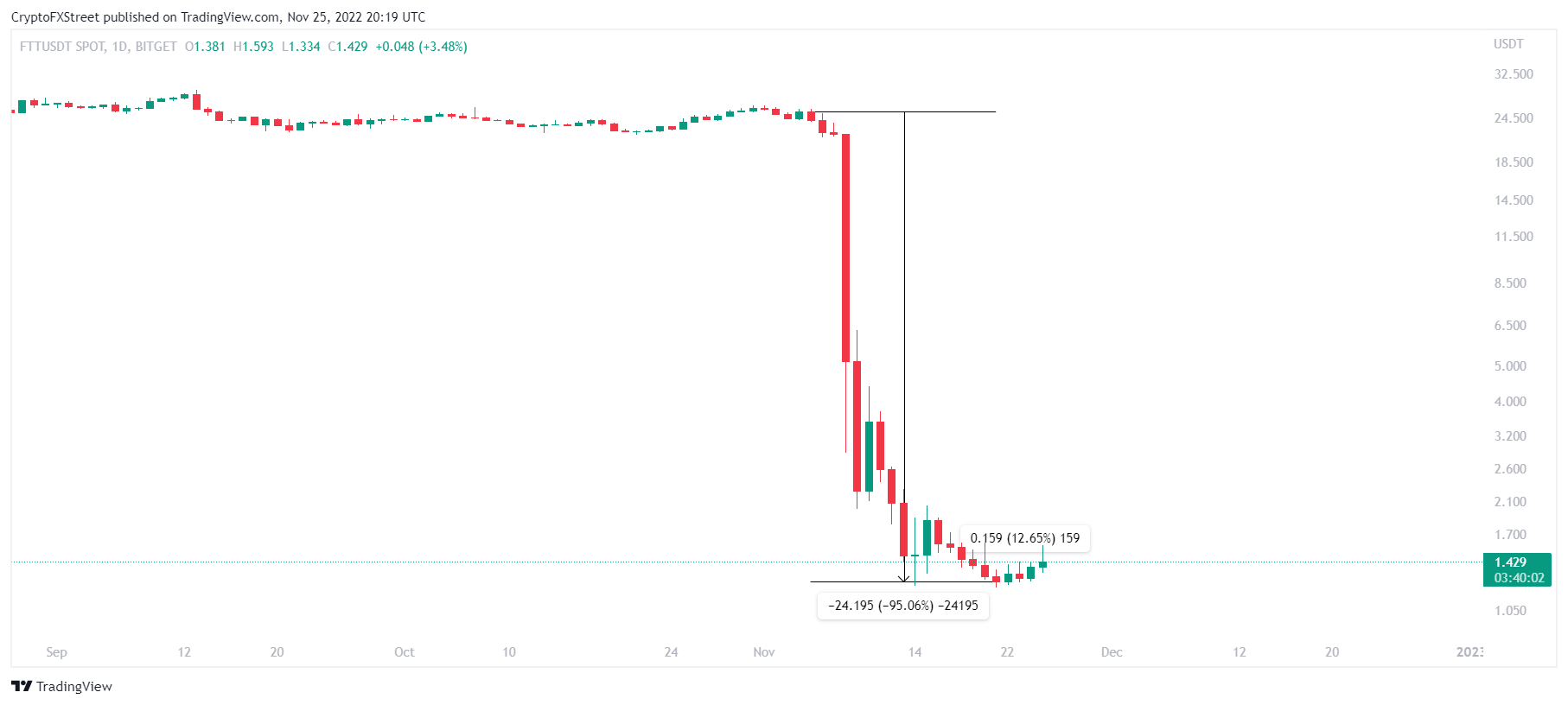

- FTT recovered by 12% in the last four days following the crypto market's improved conditions.

Genesis Global Capital has been in a downfall since the second quarter, which saw the downfall of firms like Three Arrows Capital. The collapse of FTX made the situation far worse for the lending platform. To make things furthermore problematic, the company is now being pursued by regulatory authorities.

Genesis Global Capital falls at regulators' crosshair

Genesis Global Capital (Genesis), the lending arm of the Digital Currency Group (DCG), is reportedly being investigated by US State security regulators. According to the report from Barron's Genesis is part of a multi-state investigation into the interconnectedness of crypto firms. Genesis is also said to be investigated for its connection to retail investors and will also be inquired about other industry participants' involvement in security law violations.

The Alabama Securities Commission Director Joseph Borg stated that the investigation would look into crypto companies' operations. This will reveal whether or not Genesis and other companies prompted crypto investments without making proper registrations.

Earlier this week, as reported by FXStreet, Genesis was looking at a potential bankruptcy filing due to the liquidity crunch that came with FTX's collapse. However, the lending platform confirmed that it would first attempt to raise $1 billion and fix the liquidity crisis.

Crypto company goes for a bite

The current market conditions are as it making it difficult for cryptocurrencies and companies to survive. In the midst of this, a Singapore-based company is looking to raise $100 million in funding to up its valuation to $1.5 billion funding. Matrixport, which is one of Asia's biggest crypto lenders, claims to have commitments worth $50 million from lead investors.

Whether or not the deal will go through is yet to be known since the crypto market is still fearing another contagion. FTX's collapse, which wiped out its native token FTT's value significantly, is still keeping the market subdued. Regardless, cryptocurrencies are recovering, including the likes of FTT itself.

FTT/USDT 1-day chart

The cryptocurrency noted a 12.65% increase in its value in the last four days. While this does not make any dent in the 95% drawdown the altcoin registered during November 6's crash, it still is a positive sign. This could even help the broader market in recovering, which is still struggling to breach the $800 billion mark and rise above it.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Solana plunges as ETF speculators bet billions on XRP and DOGE

Solana (SOL) price tumbles as low as $180 on Monday, down over 9% in three consecutive days of losses. Bearish dominance in the SOL derivatives markets suggests the downtrend could extend in the week ahead.

Shiba Inu Price Analysis: SHIB whale demand declines 88% amid two-week consolidation phase

Shiba Inu (SHIB) price opened trading around the $0.000016 mark on Monday, having consolidated within a 5% tight range over the last two weeks.

Solana-based meme coin LIBRA controversy heats up, Argentina President hit by lawsuit

Argentina’s President Javier Milei faces charges of fraud for the promotion of LIBRA meme coin on the Solana blockchain. An on-chain intelligence tracker links LIBRA meme coin to MELANIA and claims that the creator extracted $100 million from the former.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. US Bitcoin spot ETF data recorded a total net outflow of $580.2 million last week.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.