Gold is outperforming Bitcoin and we don't think it is a temporary market glitch

Last Thursday we had the opportunity to join Jim Cramer on the floor of the New York Stock Exchange to film an episode of Mad Money. It was, without a doubt, the most amazing experience I've had in my commodity career. On the show, I shared the gold analysis published in a recent issue of the DeCarley Perspective on the price of gold and its ability to rally should the interest rate market settle down and the US dollar continue its downtrend.

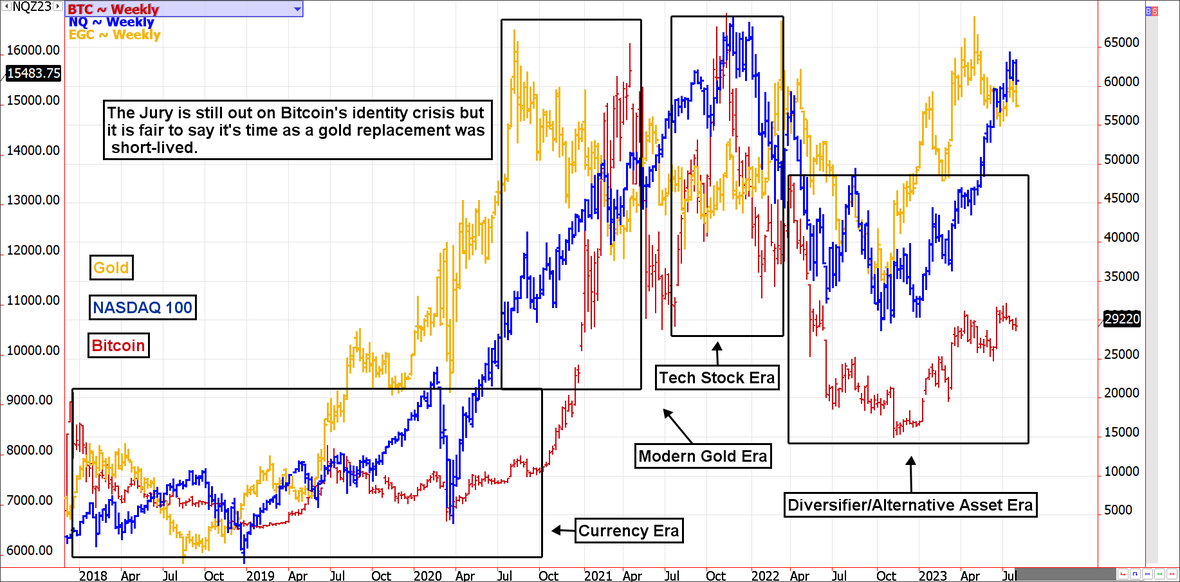

Despite years of hoopla, cryptocurrencies, and Bitcoin, in particular, is a relatively new asset. Not surprisingly, the Bitcoin market has struggled with an identity crisis. We've seen the coin identify as a transactional currency, then the bigger and better version of gold. Later it traded as a tech stock, and most recently, it has found a home as a portfolio diversifier. It is no longer trading with high positive correlations with beta stocks nor is it trading inversely to gold or the dollar. For proponents of Bitcoin, its newfound stability and independence from other asset classes is a best-case scenario.

Nevertheless, it has yet to prove to be a speculative asset that can truly compete with the stock market (which often pays dividends with more reasonable levels of volatility) and gold, which can be physically owned and bartered if the world as we know it no longer exists. Technology is great, but it isn't failsafe. Nevertheless, with the crypto sector in its infancy, the jury is still out on the final verdict. In the meantime, gold appears to be winning the marathon in the race to a risk diversifier rather than a risk enhancer.

Due to the volatile nature of the futures markets some information and charts in this report may not be timely. There is substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.