Looking for potential Market Turns in FX markets?

Many traders had come to me saying that the FX market is so unpredictable and that not only does the release of economic data move the currencies’ prices, the FX market seems to be affected by many other factors like central banks’ speeches and their intentions of raising or reducing its currency interest rates. And yet, putting aside all these news-related price movements, the currencies also seems to have a kind of rhythm to dance with themselves.

Yes, FX markets do response to a lot to expected news (such as economic data release) and unexpected news (such as earthquakes/ missile tests from Korea etc) as it pretty much runs 24 hours a day. But this is also the reason why I like to trade with FX a lot – that is, the planets in our solar system are also moving in the sky 24 hours a day as well. And they keep on giving signals to our investment markets – Don’t understand what I mean? Let’s see a few examples on how I read the markets from an astrological point of view!

How to trade with the Astrology Timing

Spot for set ups

- Mid to Long Term

First, I would like to raise a non-FX example so as to explain the theory that I am introducing to you is universal to all investment products, and that it does not only confine within the FX market.

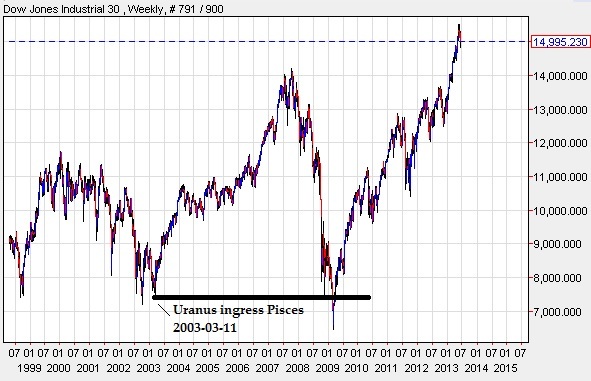

For example, on 2010-May-28 is the Uranus ingress date, and let us take a look on its interaction with the Dow Jones Industrial Index. (Shock!) See that Uranus ingress served as a ‘base’ for market to advance as time goes by.

The good news is: this price pattern is not a single-time incident, and now, all of a sudden, the market becomes predictable. Let us now trace back one earlier ingress date of Uranus –

This is what had happened when Uranus ingressed Pisces on 2003 March 11.

It (ingress of Pisces) served as a ‘base’ for the bull market in 2003 – 2007, and it worked nicely with the 2008/ 2009 financial crisis which it served as a mysterious support at the same price level.

Do you see same interaction/ price pattern going on, in both of the DJI charts?

How “Eph Alarm” will able to help you

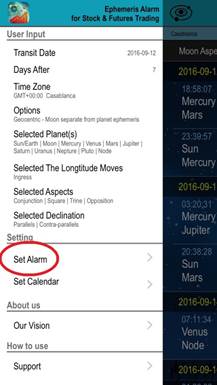

Assuming you have already downloaded the iOS app “Eph Alarm” and have watched the video which introduces basic functions of the app on "Trineaspect".

Now you can import all these ingresses date onto your apple calendar, and set an alarm from 120minutes to 3 days ‘after’ they occurred in the sky and check if they had served as ‘ bases’ in the market when the alarm reminds you of their occurrence.

Set a tight stop loss a bit below (if it serves as a bottom) or above (if it serve as a top) the ‘base’, and then you can ride with the trend together with your analysis derived from fundamental analysis or technical indicators.

You can also treat the ‘base’ as an alert that a certain trend might have changed whenever the market breaks these ingress ‘bases’!

How to import the ingress dates onto the calendar

Below are the screen shot from the app, Just click on the solar button on the Top left corner and choose Set Alarm

And clicking the right top hand Calendar button will allow you to import all these astro phenomena dates into your apple calendar.

- Short Term & Intraday Trade

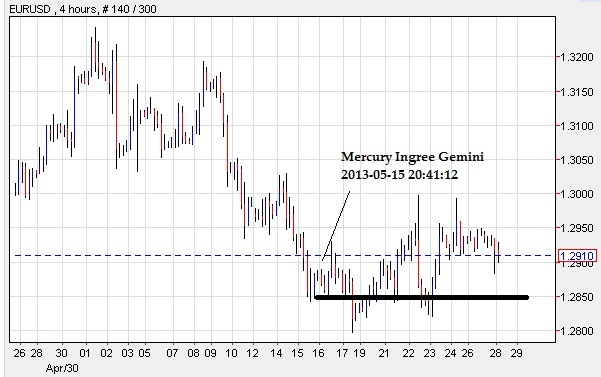

The same theory actually also applies to other faster moving planets like mercury. And now let us do another example here:

You may see when Mercury ingress Gemini, it serves another nice bottom for the Euro in May, 2013.

And for intraday traders, I personally use moon ingresses to trade with a tight stop loss around 25 pips on volatile market like JPY/ EUR/ GBP. I have traded on this strategy around 2 years now and so far it works ok

As you can see, the market usually stay near the ingress point and not moving exceed more than 25pips. and then *boom!*, and this chart showed I can easily get the 50 pips profit with little drawdown in my position. Risk Reward Ratio is 1:2.0+

Trineaspect.com and Khit Wong are not responsible for any profit or loss on actions taken on the comments shared in FXStreet.com. While the comments do not suggest nor imply in any way for any trade decisions for the readers, they are all for educational purposes.

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.