- AUD/JPY gains traction around 95.68, up to 0.12% on Tuesday.

- JPY remains under pressure after the central bank's unplanned purchase of $2 billion in Japanese government bonds on Monday.

- Market players await the Reserve Bank of Australia's (RBA) interest rate decision.

- AUD/JPY trades within a descending trend channel lines from June 18.

The AUD/JPY cross extends its upside and trades in positive territory for the third consecutive day during the early Asian trading hours on Tuesday. The cross currently trades around 95.68, gaining 0.12% on the day. Market players await the Reserve Bank of Australia's (RBA) interest rate decision later in the day.

Australia’s TD Securities Inflation figure dropped to 5.4% YoY from 5.7% in June. Meanwhile, Australia’s Private Sector Credit fell to 0.2% MoM and 5.5% YoY in June, compared to 0.4% and 6.2% prior, respectively.

Additionally, Australian Retail Sales experienced their largest decline this year in June. Australia's Retail Sales fell 0.8% MoM, against the market expectation of 0.0% and 0.7 prior. The Producer Price Index (PPI) data for the second quarter were disappointing at 3.9% YoY and 0.5% QoQ. This softer report indicated that rising borrowing costs and high prices have an impact on the Australian economy. Nevertheless, 55% of economists in a Reuters poll anticipated that the RBA is likely to raise interest rates by a quarter percentage point on Tuesday before pausing for the entire year.

On the other hand, the Japanese Yen remains under pressure as the Bank of Japan's (BoJ) unscheduled operation on Monday to purchase 300 billion ($2 billion) worth of Japanese government bonds (JGB) keeps yields stable for the first time since February 2022.

Japan’s Economy Minister Shigeyuki Goto stated on Tuesday that the BoJ's decision last week was intended to increase the sustainability of monetary easing by increasing the flexibility of the YCC. He added that he does not believe that the BoJ's decision on Friday represented a shift in its monetary easing stance.

AUD/JPY: Technical outlook

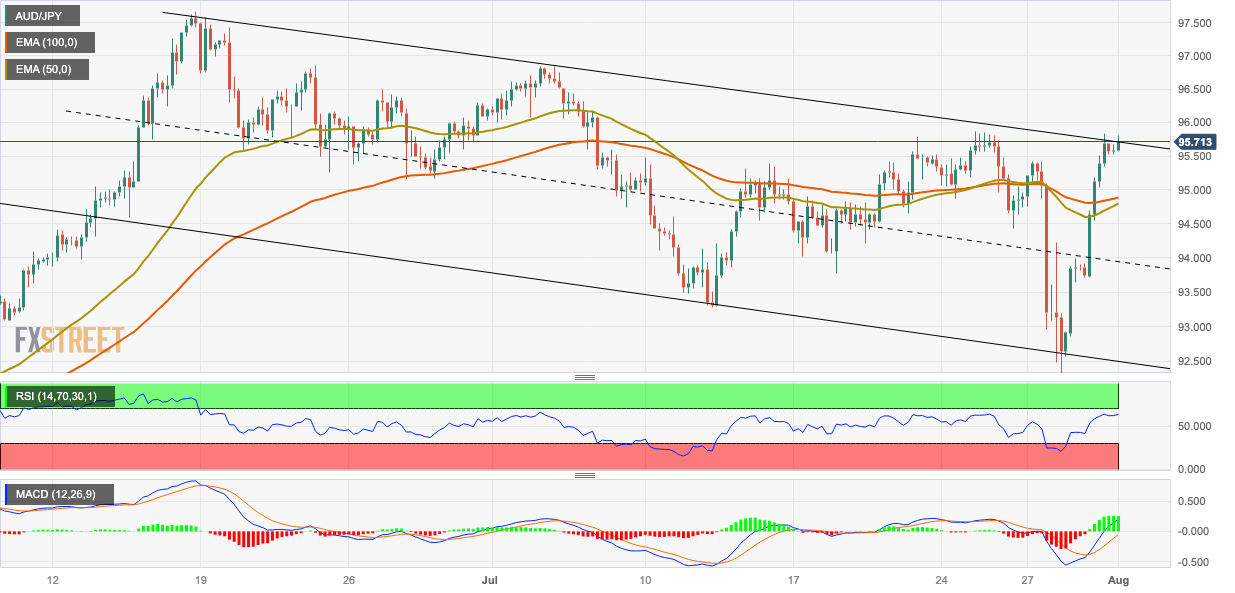

According to the four-hour chart, AUD/JPY trades within a descending trend channel line from the middle of June. The Relative Strength Index (RSI) and MACD hold in bullish territory, suggesting that the path of least resistance is to the upside.

Resistance levels: 95.80 (High of July 31, upper boundary of a descending trend channel), 96.85 (High of July 4), and 97.60 (High of June 16, YTD high).

Support level: 94.90 (100-hour EMA), 94.80 (50-hour EMA), 94.00 (a psychological round mark, midline of descending trend channel), and 93.30 (Low of July 12).

AUD/JPY four-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.