- Bitcoin dominance tends to influence altcoins, with its pump or slump impacting altcoins differently.

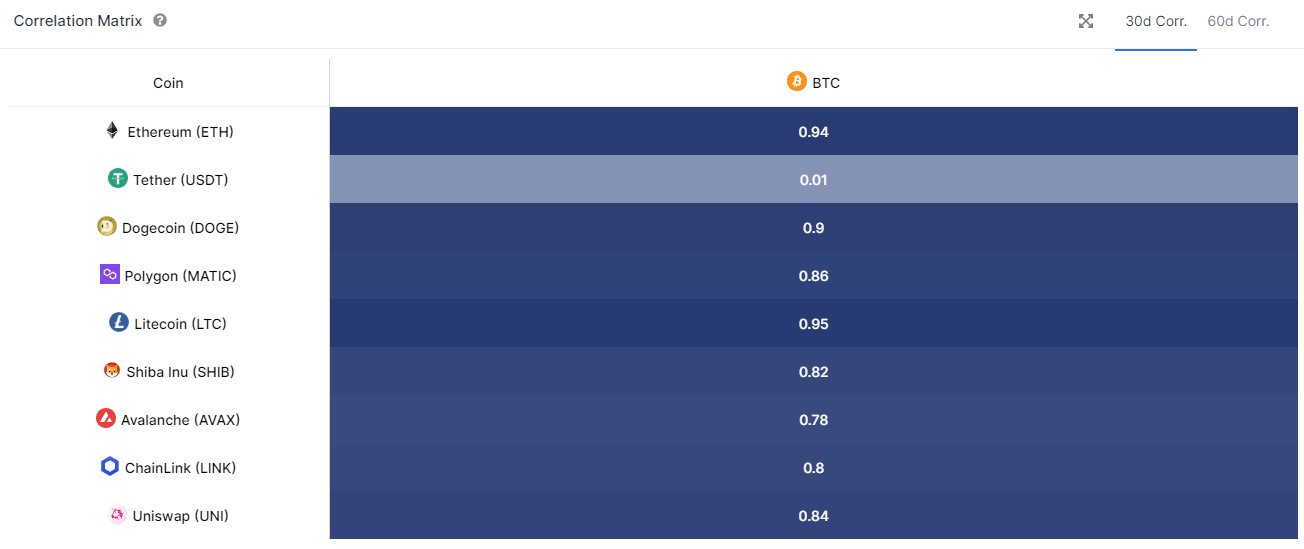

- Data from IntoTheBlock shows BTC’s correlation with Litecoin is stronger than with Ethereum, while Dollar-pegged USDT tails the list.

- A lower correlation is excellent for diversification, offering trading opportunities despite broader market lull where BTC remains range-bound.

Bitcoin (BTC) price is nurturing an uptrend, and with it, several altcoins are moving north. This effect, where the price action of BTC is mirrored or reflected in the price action of another asset, is called correlation. It is often influenced by several factors, including market conditions, investor sentiment, and regulatory developments.

Outside crypto, BTC has a correlation with different assets in the financial playing field, including the US Dollar (USD) and Gold. This explains the narrative, “Bitcoin is trading like a tech stock” alongside its often acute inverse relationship with the United States dollar. Read more on this here.

The correlation with TradFi assets, however, tends to show less consistency compared to crypto. Specifically, while Bitcoin’s correlation with the USD or Gold may change from time to time, it remains rather fixed for most of crypto.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Is BTC ready for a pullback or is it a fake out?

Bitcoin correlation with cryptocurrencies

On-chain analytics and market intelligence platform IntoTheBlock has a Bitcoin Correlation Matrix, which shows the lead crypto’s correlation with other cryptocurrencies.

According to IntoTheBlock’s Matrix, BTC has a correlation score of 0.95 with Litecoin (LTC). This is relatively high since the highest possible is 1.00. A correlation of 1.00 means the two cryptos 100% reflect each other’s price changes.

The lowest correlation possible is -1.00, which means the two variables, or in this case, cryptocurrencies, actually exhibit a 100% negative correlation or move in the exact opposite direction to each other.

A result of 0 means there is no relationship whatsoever between the two variables. BTC also has a high 0.94 correlation to Ethereum (ETH).

Bitcoin correlation matrix

Smart investors tend to spread their risk by investing in different cryptocurrencies, as opposed to putting all their money in one basket. This is called ‘portfolio diversification’. It prevents investors from losing all their money in one go.

In order to achieve portfolio diversification, it is advised not to invest in highly correlated assets, because a slump affecting one will affect them all, leading to greater losses.

For investors with large holdings of Bitcoin, therefore, it would be unwise to accumulate too much ETH or LTC. The high correlation with Litecoin is not surprising, in fact, given the altcoin is itself the product of a BTC fork.

BTC/USDT 1-day chart, ETH/USDT 1-day chart, LTC/USDT 1-day chart

How correlation affects portfolio diversification

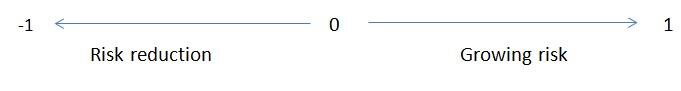

According to portfolio diversification theory investors should steer away from owning too many assets that share a correlation close to 1.0, Assets with a correlation that is as low as -1.0 (perfectly negatively correlated), however, yield maximum risk reduction and should be sought.

Correlation vs. Risk scale

It is not possible to find a crypto that is perfectly negatively correlated to Bitcoin. Even stablecoins, which are the least correlated, are nevertheless not negatively correlated to BTC either. The leading one, Tether (USDT), shows a 0.01 correlation. This low correlation explains why USDT tends to get attention when BTC volatility peaks.

BTC correlation with USDT

Traders use USDT to respond to the volatility of Bitcoin. When BTC price goes bearish, they sell, and because they do not want to leave the crypto market entirely, they convert their assets to USDT, before awaiting a market improvement. During such instances, it is possible to note high volumes of USDT move from exchange wallets to private wallets.

When markets start improving, the reverse happens, with experienced traders starting to move USDT to exchange wallets in readiness to buy BTC at discounted rates.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.