Introduction

The Contract for Difference (CFD) market is on an upward trajectory, with projections indicating a 4.3% Compound Annual Growth Rate (CAGR) from 2023 to 2028. Originating in London in the early '90s as a hedging tool, CFDs have evolved into a popular retail investment vehicle, thanks to the advent of online trading platforms that provide traders with a plethora of advanced tools and information. However, traders often find themselves on the losing end. Why is that? Let's delve deeper. Are you ready to shift your focus from how to why? Let's embark on this journey to redefine your CFD trading strategy.

The allure of CFD trading

The CFD market offers an array of advantages that are hard to ignore. Trading platforms provide easy access to a multitude of financial markets—be it stocks, commodities, or currencies while traders benefit from advanced trading tools provided by brokerage firms such as:

-

Real-time market alerts

-

What It Is: Real-time market alerts notify traders instantly about significant market events, price movements, or changes in trading volumes.

-

Why It's Important: These alerts allow traders to make timely decisions, capitalizing on market opportunities or averting potential losses.

-

-

Sentiment analysis based on news

-

What It Is: This tool scans news articles, social media, and other public communications to gauge market sentiment—be it bullish, bearish, or neutral.

-

Why It's Important: Understanding market sentiment can offer traders a psychological edge, helping them anticipate future price movements.

-

-

Expert insights and latest market trends

-

What It Is: Platforms often provide articles, webinars, or videos from seasoned traders or financial analysts that offer in-depth market analysis.

-

Why It's Important: These insights can help traders understand the market context, making it easier to spot profitable trading opportunities.

-

-

Economic and corporate calendars

-

What It Is: These calendars list important dates such as earnings releases, economic data publications, or central bank meetings.

-

Why It's Important: Being aware of these events enables traders to prepare for market volatility and adjust their trading strategies accordingly.

-

-

Trading signals and copy trading options

-

What It Is: Trading signals are suggestions for entering a trade on a specific currency pair, stock, or other financial instruments. Copy trading allows traders to automatically copy the positions opened by another trader.

-

Why It's Important: These features can be particularly useful for novice traders or those who prefer a more hands-off trading approach but still want to benefit from market opportunities.

-

-

Optimum trade size calculators

-

What It Is: This tool calculates the ideal size of a trade based on various factors such as the trader's risk tolerance, account size, and the volatility of the asset being traded.

-

Why It's Important: Proper position sizing is crucial for risk management and can significantly impact a trader's long-term profitability.

-

-

Comprehensive risk management tools

-

What It Is: These are a set of tools designed to help traders manage their risk. They may include stop-loss orders, take-profit orders, and risk-to-reward ratio calculators.

-

Why It's Important: Effective risk management can mean the difference between a profitable trading career and significant financial loss.

-

The paradox: Information overload

While an extensive set of trading tools may indicate a high probability of trading success, the paradox lies in the fact that many traders experience the exact opposite as they suffer significant losses when trading CFD markets. The abundance of resources often leads to information overload, causing traders to lose sight of their strategic objectives. The focus inadvertently shifts from understanding the 'why' behind using a particular tool to merely figuring out the 'how.'

Understanding the mechanics of each tool and the data they provide is undoubtedly important. However, the key to successful trading lies in developing a well-defined strategy. This involves not just knowing how to use your tools, but more importantly, understanding when and why to employ them.

Bridging the gap: The importance of strategy

The challenge is to integrate tools and information in a manner where each one enhances the other, thereby creating a cohesive and effective trading strategy. By doing so, traders can navigate the complexities of the market with a clear plan, rather than getting lost in a sea of tools and information.

The secret to fully harnessing the capabilities of CFD trading resides in strategic planning. Traders must synergize various tools and data in a cohesive manner. Thus, the focus shifts from merely understanding how to utilize these resources to discerning why they are being employed to begin with. This approach will lay the groundwork for clear trading objectives, routes, and ultimately, a resilient trading strategy.

Integrating tools for a cohesive CFD trading strategy

Example

The key to creating a successful trading strategy lies in the synergistic use of various trading tools. Each tool provides a piece of the puzzle, and when used in a complementary manner, they can offer a comprehensive view of the market.

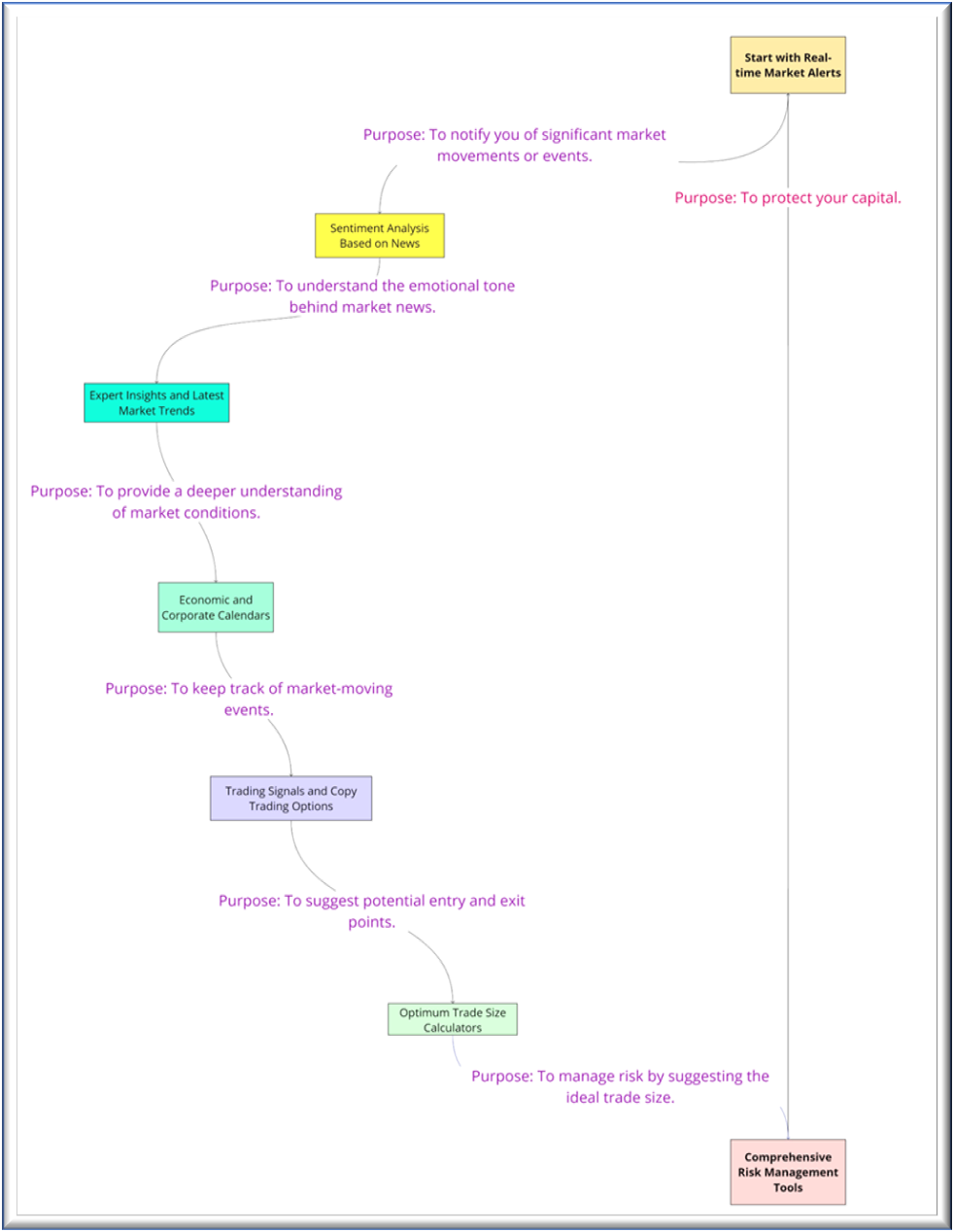

Here's an example of how these tools can be integrated to form a cohesive trading strategy:

Step 1: Start with real-time market alerts

Purpose: To notify you of significant market movements or events.

Complementary Tool: Sentiment Analysis based on News

Strategy: Use real-time alerts to identify potential trading opportunities. Validate these opportunities with sentiment analysis to gauge market mood.

Step 2: Sentiment analysis based on news

Purpose: To understand the emotional tone behind market news.

Complementary Tool: Expert Insights and Latest Market Trends

Strategy: After identifying market sentiment, consult expert insights to understand if the sentiment is likely to continue or is a temporary market reaction.

Step 3: Expert insights and latest market trends

Purpose: To provide a deeper understanding of market conditions.

Complementary Tool: Economic and Corporate Calendars

Strategy: Use expert insights to identify long-term trends. Cross-reference with economic calendars to understand if upcoming events will support or contradict these trends.

Step 4: Economic and corporate calendars

Purpose: To keep track of market-moving events.

Complementary Tool: Trading Signals and Copy Trading Options

Strategy: Use the calendar to anticipate market movements and employ trading signals to time your entry and exit points.

Step 5: Trading signals and copy trading options

Purpose: To suggest potential entry and exit points.

Complementary Tool: Optimum Trade Size Calculators

Strategy: Once a trading signal aligns with your strategy, use trade size calculators to determine the appropriate position size.

Step 6: Optimum trade size calculators

Purpose: To manage risk by suggesting the ideal trade size.

Complementary Tool: Comprehensive Risk Management Tools

Strategy: Use the calculated trade size to set up your risk management tools effectively, such as stop-loss and take-profit orders.

Step 7: Comprehensive risk management tools

Purpose: To protect your capital.

Complementary Tool: Real-time Market Alerts

Strategy: Continuously monitor market alerts to adjust your risk management settings, ensuring you're not caught off guard by sudden market movements.

By acting complementarily on these steps, traders not only create a strategy but also understand why they are using specific tools and information. This holistic approach ensures that each tool serves a purpose and complements the other, leading to a more informed and effective trading strategy.

The chart below shows the coherent trading strategy

The way forward: Expert consultation (advisory) and AI integration

To achieve this level of strategic coherence, two elements are crucial:

-

Expert Consultation (Advisory): A seasoned trading advisor can provide invaluable insights into how best to utilize these tools, based on years of experience and market understanding.

-

AI Integration: Artificial intelligence can play a pivotal role in synthesizing and integrating this plethora of tools and information. AI algorithms can sift through the noise to highlight what truly matters, aiding in the formulation of a winning strategy.

Let's explore the roles of Expert Consultation and AI Integration in creating an effective trading strategy.

1. Expert consultation (advisory)

Role

An expert advisor brings years of market experience and a nuanced understanding of trading dynamics. Advisors can guide traders in interpreting market signals, understanding trends, and making informed decisions.

Modus operandi

-

Initial Consultation: The advisor initiates the process by understanding trader's trading goals, risk tolerance, and market preferences.

-

Tool Selection: Based on trader's profile, the advisor recommends which tools would be most beneficial for trader's.

-

Strategic Oversight: The advisor helps trader's interpret the data from various tools and guides trader's in forming a strategy that aligns with trader's goals.

-

Continuous Monitoring: The advisor keeps track of the strategy's performance and suggests adjustments as market conditions change.

2. AI integration

Role

Artificial Intelligence acts as the backbone for data analysis and decision-making. It can process vast amounts of data at high speeds, providing real-time insights that would be impossible for a human to analyze in a timely manner.

-

Data Aggregation: AI algorithms can quickly aggregate data from various sources, providing a comprehensive view of the market.

-

Pattern Recognition: AI can identify market patterns more quickly and accurately than a human, enhancing the effectiveness of tools like sentiment analysis and trading signals.

-

Automated Risk Management: AI can automatically adjust risk management settings in real-time based on market conditions, ensuring optimal protection for your investments.

-

Strategy Optimization: Over time, AI learns from the performance of your trades to continuously refine and optimize your trading strategy.

Integrated strategy

-

Step 1: Use Real-time Market Alerts to identify potential trading opportunities. Validate these with Sentiment Analysis, under the guidance of your advisor.

-

Step 2: Consult Expert Insights to understand if the sentiment is likely to continue. Cross-reference this with Economic and Corporate Calendars, using AI for pattern recognition.

-

Step 3: Employ Trading Signals to time your entry and exit points, optimized by AI algorithms.

-

Step 4: Use Optimum Trade Size Calculators to determine the appropriate position size, advised by your financial advisor.

-

Step 5: Set up Comprehensive Risk Management Tools, continuously monitored and adjusted by AI technology.

-

Step 6: Regularly consult with your advisor to review strategy performance and make necessary adjustments, aided by AI's continuous learning capabilities.

Synergy of expert consultation (advisory) and AI integration

The combination of human expertise and AI capabilities creates a robust trading strategy:

-

The advisor sets the strategic direction and provides the human touch of understanding market sentiment and psychology.

-

AI takes on the heavy lifting of data analysis, freeing up the advisor to focus on more complex decision-making.

By integrating both elements, traders can achieve a level of strategic coherence and effectiveness that is greater than the sum of its parts. This holistic approach ensures that traders are not just reacting to the market, but proactively engaging with it in a meaningful way.

Conclusion: The shift from how to why

The journey from understanding the 'how' to grasping the 'why' in CFD trading is a transformative one. It's not just about leveraging a multitude of advanced tools but about integrating them into a cohesive, well-defined strategy. The key to unlocking the full potential of CFD trading lies in this integration, guided by the seasoned insights of expert consultation and powered by the analytical prowess of AI technology. Together, these elements form a synergistic approach that not only enhances individual trading decisions but also elevates the overall trading strategy to a level of sophistication and effectiveness that is truly greater than the sum of its parts. In this way, traders can navigate the complexities of the CFD market with confidence, armed with a strategy that is both reactive and proactive, both human and data-driven.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.