How many times have you heard the following from Wall Street, the financial media, your CPA or your financial advisor, Max out your 401(k)? Almost every day there is another article on how and why you should Max out your 401(k).

The marketing powerhouses behind Wall Street programs tells us to contribute as much money as we can to our 401(k)’s. But why? Is this really the best way to save for your retirement? Who really benefits, you or banks and financial institutions?

There are two primary benefits to contributing to your 401(k):

-

Tax deferred growth – your 401(k) contributions are tax deductible and grow tax deferred. However, when you need the money the most during retirement, your withdrawals are 100% taxed.

-

Your employer provides a match on your contributions – typically a company matches your contributions up to a certain amount or percentage. This is a big benefit because it’s free money and there aren’t too many places where you can find free money.

Most people understand these benefits upfront but don’t really think about the consequences of over contributing until they’re retired and it’s too late.

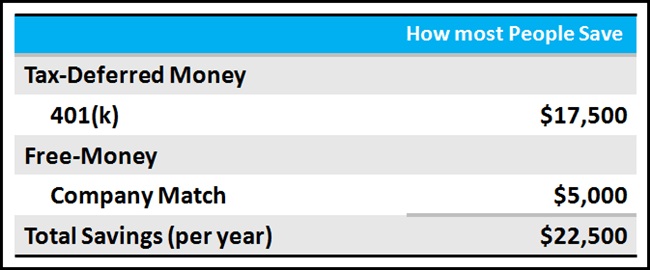

How Most People Save for Retirement

Say you’re age 40, plan to retire at age 65 and you intend to max out your 401(k) contributions for 25 years. That maximum per year is $17,500. In addition, you will receive a $5,000 company match. So your total savings for the year will be $22,500, as illustrated below.

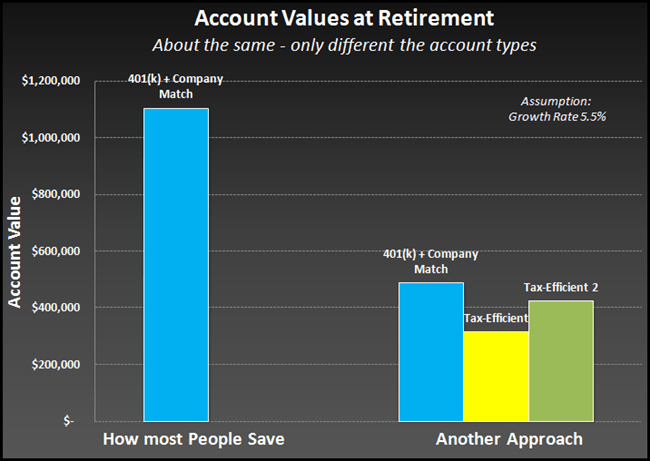

Assuming a modest 5.5% growth rate, over the 25 years your 401(k) account value will grow to roughly $1.1 million. That’s the good part. The challenge, what most people don’t realize is this money has been growing tax deferred, but when it comes time to withdraw, both your contributions and your gains will be taxed and taxed hard.

In our program, we teach students a concept called Power Ranking your Money and I want to share this with you here. The four different types of money, ranked best to least best, are:

-

free money – a 401(k) company match is considered free money

-

tax-free money – money you can access without paying taxes (i.e. Roth IRA)

-

tax-deferred money – traditional monies from a 401(k) or IRA, where you get the upfront tax deduction, tax-deferred growth and pay taxes when you withdraw

-

taxable money – every other kind of money falls in the taxable money category… we want to avoid this as much as possible. There is no tax advantage now or in the future.

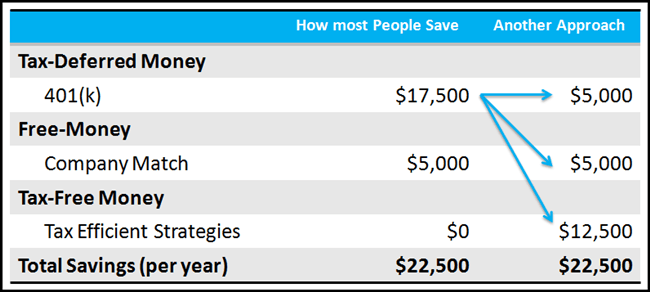

Smart Saving For Retirement

Now take a look at why it’s so important to apply the power-ranking-your-money concept (this is what we teach our students). Let’s say an investor wants to save the same $22,500 a year. We know the company match is $5,000/year and so we’re only going to put that amount into the company 401(k); we want to take the free money. But, the remaining $12,500 will be saved utilizing another tax efficient strategy you may not be aware of. Basically, you’re still saving $22,500 per year but the money is allocated differently.

Still assuming the same 5.5% growth rate, over the 25 years your account value will grow to roughly the same $1.1 million. However, due to the benefits of power-ranking you earn and keep more money.

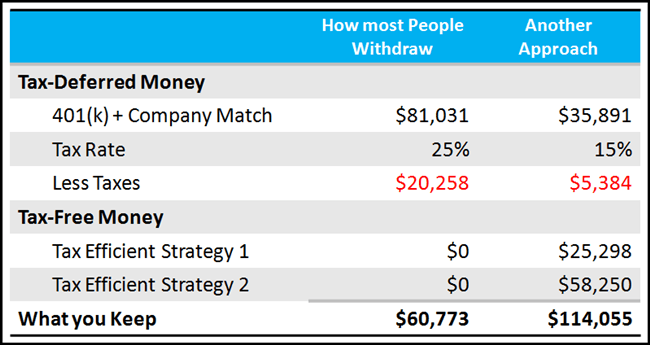

To demonstrate why max out your 401(k) is a bad idea, let’s say at retirement you want to withdraw the same amount every year for 20 years until the funds are depleted.

With the traditional approach (what most people do) you take out $81,031 each year from Tax-Deferred Money (401k + company match). Don’t forget you need to now pay taxes on this money… at a tax rate of 25% you’ll pay $20,258 in taxes and so you end up keeping $60,773.

With the Alternative Approach you’re going to take out $35,891 from your tax-deferred account. Since you’re taking out less money you get the benefit of a lower tax bracket and only pay 15% in taxes or $5,384. Now, here is where the real advantage comes in… Remember those other accounts you saved in over the 25 years? Those funds were growing in tax-free accounts. Now, at retirement you withdraw $28,298 and $58,250 from two different types of tax-free money accounts and pay zero taxes on that money (if designed properly). If you add those numbers up you’re actually keeping $114,055.

That’s a difference of over $53,000 that you’ll be putting in your pocket every year. And remember, you’re withdrawing for 20 years and over that 20 year period you’ll be putting in your pocket over $1.0 million.

You could argue, take the tax savings and invest it. If you run those numbers, you get a little more benefit but it still does not compare. Most folks don’t end up investing the tax savings anyway, they end up spending it.

While the example above is very simplified, the main point is to think about the max and understand that there is another strategy that may be a much better option for you. So why doesn’t Wall Street teach you about these concepts? Here’s a hint… mutual funds. What types of investment vehicles are mostly found in 401(k)s? That’s right, mutual funds. And what do most mutual funds have in common? If you said fees you are correct, and most are not cheap. Who benefits from these fees charged in your 401(k) mutual fund? Right again, Wall Street Banks and Financial Institutions.

Banks and institutions are simply using smart strategies to attain profits and are very smart with their money and the vehicles they save in. Learn to think and act like Wall Street. Utilize strategies that put more money in your accounts, not the accounts of banks and financial institutions.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.