Outlook: Today we get import prices, the Philly Fed’s Harker, and the University of Michigan consumer sentiment index(expected down to 67.4 in Oct from 68.1 in Sept. None of these are FX movers.

Inflation yesterday was unsatisfactory in that an ongoing downward move didn’t happen. Also, jobless claims didn’t rise. Two negatives are two positives for the Fed rate hike outlook, although it must be admitted that if shelter costs keep falling, the next few reports could very well satisfy the Fed. Then we have to guess whether the Fed’s economists are seeing it that way, too, which could lead to a warning that another hike would be overkill.

But as the 10-year yield went soaring again to close back up near those scary recent highs, plenty of folks are wondering whether high and perhaps rising long-term rates are a substitute for another hike. This was suggested by several Feds in recent days. The WSJ reports that the probability of another hike went from 30% to 40% after the inflation news and bond yield spike. The CME Fedwatch tool does not have the same info. It still shows the probability for a Nov hike at less than 10% and for the Dec 13 meeting, 32%.

Again we refer to the Fed’s meticulous attention to its reputation and credibility. It says it is following the rule of inflation being the data that rules the rate decisions. It may be willing to fudge a little on the subject of lag or even, as many have suggested, lift the target from an outdated 2%. But substitute bond yields for inflation? No.

Today the WSJ writes the substitution idea is actually a “new Fed theory.” Well, no. It’s true that Dallas Fed Pres Logan started the idea, saying yield rises do the job of the Fed by tightening conditions. Others chimed in, including Fed Vice Chair Jefferson and Atlanta Fed Bostic.

Here is the WSJ rebuttal: “It seems obvious that higher bond yields and mortgage rates ought to slow the economy. But the theory has some serious flaws.

“First, the cause of the higher term premium is probably the government’s extensive borrowing, which should be boosting the economy. Second, it’s dangerous for the Fed to be pushed into raising rates—or not raising them—by the markets. And third, the Fed didn’t feel the need to do the opposite when falling bond yields were more than offsetting the Fed’s tightening at the end of last year, so why now?”

The WSJ dives into the weeds with a primer on the “term premium,” the extra return demanded by the market for the risk of holding paper for a long period od time. Even the WSJ, some funnily, says “It’s hard to pin down, but in theory is simple…”

We have an internal contradiction of risk on the economic front, mostly inflation, and what the government is doing, issuing vast amounts of new debt to pay for an ever-rising deficit. Budgets are out of control.

To some extent, so is the economy. “According to Financial Conditions Indexes from the Chicago Fed and from Goldman Sachs—constructed differently, but including stocks, corporate credit and the dollar as well as Treasurys—the overall effect of finance on the economy is still less restrictive than it was a year ago. That is despite the recent jump in bond yields and the Fed raising rates more than 2 percentage points to a range between 5.25% and 5.5%.

“Focus on financial conditions rather than just Treasury yields and you could easily argue that more rate rises are required, the exact opposite of the new doctrine being floated at the Fed.”

As in so many arguments, we disagree with the underlying premise that the Fed has a new “theory” or “doctrine.” A few members noting that high yields are an automatic tightener is not the embrace of a doctrine. It’s an observation.

Two points: data informs sentiment but is not sentiment itself. This is the error many analysts make. Any number of other factors are involved in sentiment. A single data point rules sentiment only on special data releases, including inflation, and institutional events, like central bank meetings. This time, the yield theory throws mud on the preeminence of inflation data as the sentiment driver. It can easily mess up the currency response, too.

Second, maybe those betting against the Nov/Dec hike are not totally nuts. See the NY Fed tidbit below.

It’s a little interesting that in the UK, we have no such silly talk and the Bank of England is stocking to the party line that policy will have to be restrictive for some time.

Forecast: The dollar has regained a lot of ground in a very short period of time. The normal response to such a big move is a pushback, although in the case of the euro, it’s not likely to exceed the recent high (1.0635). We say the talk of a “new theory” at the Fed, using yield gains as a substitute for a rate hike, is hogwash. It’s not a theory and the Fed did not embrace it. And because it’s Friday, most bets should be off and especially this time, as we await the Israeli ground invasion of Gaza. But Friday the 13th being an unlucky day is hogwash, too.

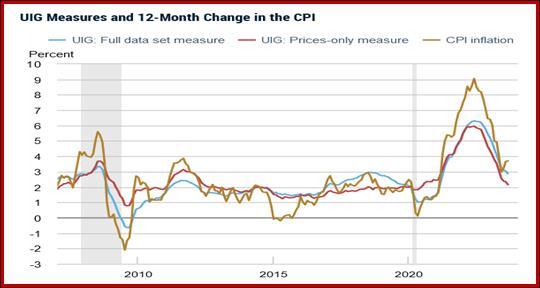

Tidbit: The New York Fed’s underlying inflation gauge was published yesterday.

This time the UIG has Sept inflation at 2.9%, down 0.1% from the month before. Remember, CPI was 3.7%, the same as the month before. That’s the “full data set” version. Another version is the “prices only” and that gets 2.2%, a drop by 0.2%.

If Main Fed is heeding the New York Fed, it might be starting to think its hiking days are over. But there are 12 regional Feds, may with their own models (Cleveland, San Francisco, Atlanta), not to mention the economic team in Washington. So it’s not likely. But we think the NY Fed gives us cause to pause in relentless hawkishness.

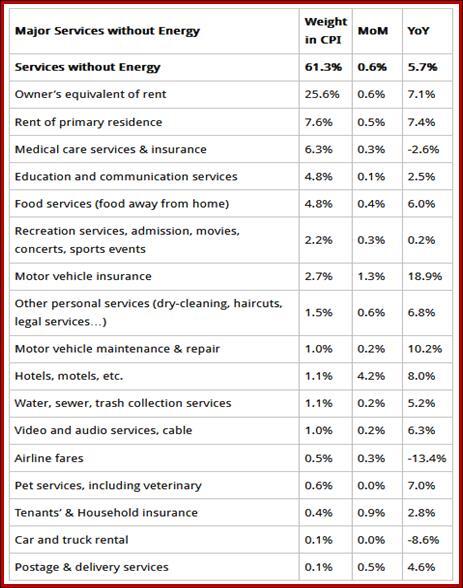

Tidbit: Besides, Wolf Street reminds that next month we are in for an unhappy surprise—the cost of health care. The BLS has been placing it lower for a total of 37.3% year-over-year. “Today’s CPI release is the last month with that adjustment; with the October CPI, to be released next month, the health insurance CPI will flip, adding further upward momentum to the CPI readings, instead of pushing them down.”

Wait, it gets worse: “The health insurance adjustment has caused CPI, core CPI, and core services CPI to be understated to an increasingly significant extent since October 2022, when the monthly health insurance adjustment started, one of the biggest data distortions resulting from the data chaos of the pandemic…”

And as many have noted, we got lucky with the cost of energy in the month. Heaven only knows where it’s going.

Wolf Street offers a table of various services in the service sector part of the CPI and core. It’s worth a look on a Friday. The Wolf Street newsletter is free and worth a look if you like a sane and reasonable and readable explanation of data.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.