- Correlation of the US Dollar Index with Bitcoin has been on a steady rise, hitting a 10-month high at 0.73.

- The last time this happened, BTC started 2023 rally, but it is unlikely to be the same this time.

- Going forward, the $30,000 mark is critical in Q4 of 2023, with a failed breach likely to reduce uptrend chances drastically.

Bitcoin (BTC) price upside potential heavily depends on its correlation with the US Dollar Index (DXY), with recent data showing that BTC folded as investors mused on the Federal Reserve’s (Fed) decision to pause interest rate hikes for September. This occurred while they anticipated a stronger financial grip going forward. At the time, BTC price dropped below the $27,000 support, with subsequent attempts to reclaim above this psychological level proving to be a hard task until the big break on October 1.

Also Read: Bitcoin correlation cheat sheet for portfolio diversification

Bitcoin correlation with DXY hits 10-month high

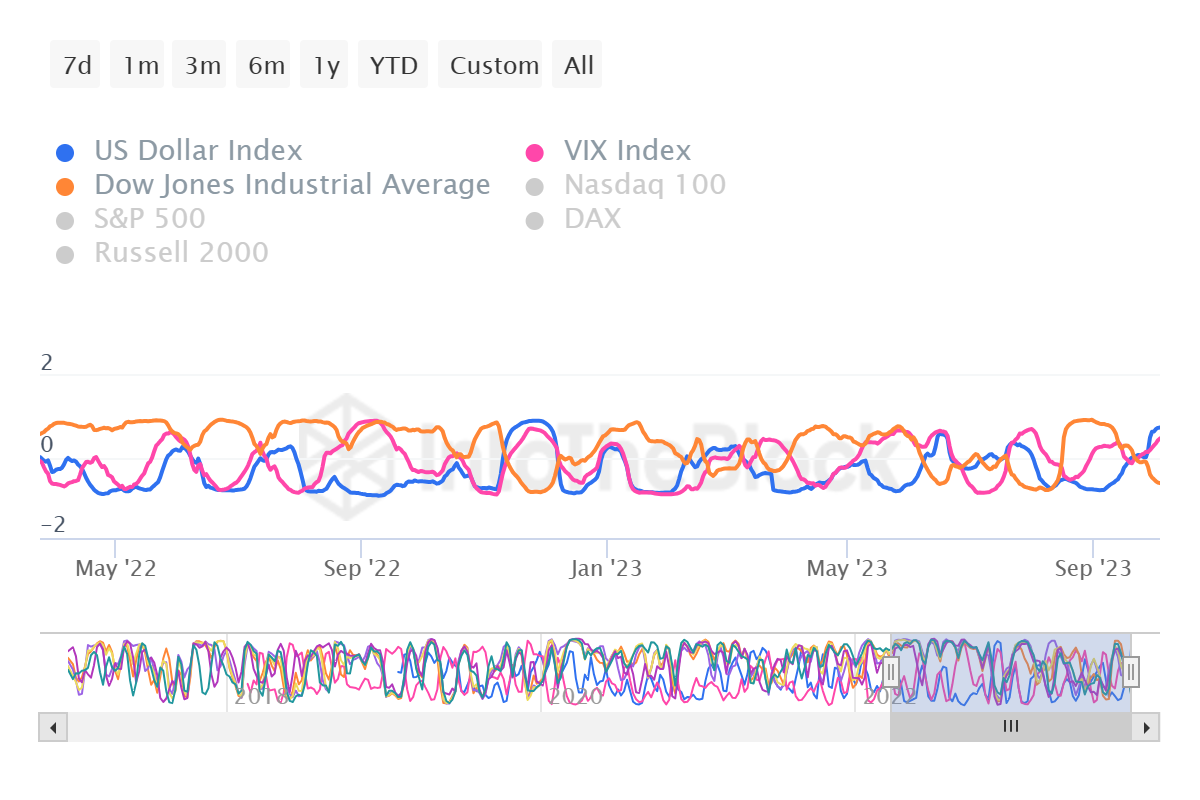

Bitcoin (BTC) correlation with the US Dollar Index has hit a 10-month high, at 0.73 based on historical correlation data according to IntoTheBlock. The last time it came this high was around December 2022, when it recorded a correlation of almost 0.90. A correlation coefficient ranges from -1 to 1, with -1 indicating a perfect inverse relationship, 1 indicating a perfect direct relationship, and 0 indicating no relationship. In this context, a 0.73 or 0.90 correlation would indicate a strong positive relationship.

BTC DXY historical correlation

The heightened BTC DXY correlation in December kickstarted the 2023 rally, sending Bitcoin price around 95% to the April highs above the $30,000 mark, before the Terra saga provoked a crash across the ecosystem, kickstarting the bear market that the industry is only now trying to escape.

In part, the rally was supported by the Fed printing money in 2020 in its efforts to prevent a recession, with the ensuing liquidity influx buffering the market and causing a surge among financial markets, stocks, and crypto included. However, with liquidity now washing away, the market is left susceptible to a crash.

Many indicators are pointing to an incoming recession in the US. This comes as markets approach the end of the most significant global rate hike cycle in history by central banks. This situation becomes worse as the market rides on the back of the biggest liquidity pump that is in turn dumping fast. As such, based on the dynamic that liquidity pumps fuel a surge in markets, just as much as liquidity dumps trigger a slump,

Crypto might be leaning into a recession. Why Bitcoin price could dump

There are clear indications of a recession across Europe, deteriorating growth in China, and ultimately the US. Typically, the global economy is going into a potential recession. A pump in liquidity followed by eased interest rates, with the Fed expected to pivot in 2024 and embrace a softer approach, Bitcoin price is likely to fall.

Growing inflation, assets dumping, and the Fed’s inclination to not providing liquidity, the $30,000 level is therefore critical, marking a key resistance that must be breached before the end of 2023 for an uptrend to ensue. Failure to do so and we walk into 2024 still under the $30,000 level will reduce the chances of an uptrend drastically.

BTC/USDT 1-day chart

A senior macro strategist with Bloomberg Intelligence, Mike McGlone, says that going forward, the biggest risk for crypto will be pressure due to an ebbing tide, supposing the stock market records a typical drawdown for a recession. In this case, cryptos may be at the forefront of a lower recession, with consolidating bear markets awaiting a catalyst.

Also Read: US Dollar Index hits a ten-month high - Is Bitcoin price preparing for a crash?

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.