- Australia will publish Q1 inflation figures next week, seen rapidly accelerating.

- Central banks’ hawkishness undermined demand for high-yielding assets.

- AUD/USD bearish momentum is set to accelerate on a break below 0.7233.

The AUD/USD pair kept falling in the last few days, reaching a fresh multi-week low of 0.7248 on Friday, to close the trading week a handful of pips above it. Global stocks traded dully throughout the week, collapsing on Friday, dragging the commodity-linked currency down with them. The pair enjoyed a couple of positive days mid-week as Wall Street earnings season´s surprises underpinned indexes.

The usual suspects

What’s behind the American dollar’s continued strength? There is nothing new moving financial markets. Ever since the pandemic started in March 2020, concerns have revolved around slowing economic progress. Once the world started seeing some relief, Russia invaded Ukraine, and the coronavirus returned to China. Supply-chain issues retook center stage roughly a month ago when Shanghai announced it will put under strict lockdown over 26 million people.

The decision has exacerbated the pandemic-related bottlenecks, which in turn fuel inflation levels. The Reserve Bank of Australia recently joined the hiking train, as in its latest monetary policy meeting, policymakers opened the door for a rate move. For the time being, the central bank is expected to hike some 40 bps by June. Still, it is way behind the US Federal Reserve, which is expected to push rates towards the 2.75%-3% range by the end of the year, another reason behind AUD/USD’s slide.

The aussie fared quite well with the Russian-Ukraine crisis, as higher commodity prices have provided support. However, as the crisis extends and the market prices in a long haul conflict, gold and oil prices have begun receding. The bright metal ended the week with losses at around $1,930 a troy ounce, after a failed attempt to regain the $2,000 level earlier this month.

Growth and inflation coming up next

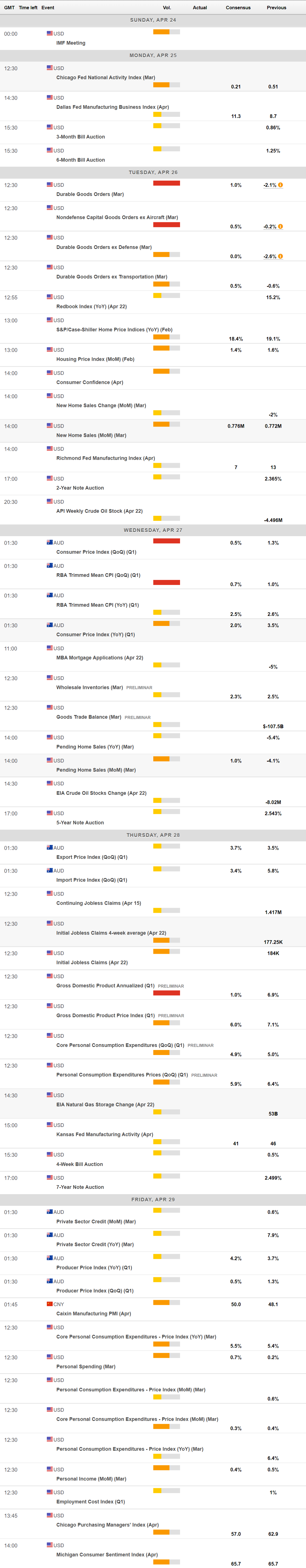

Data wise, the macroeconomic calendar had little to offer in the last few days. Australia published the Westpac Leading Index, which printed 0.35% in March. The preliminary estimates of the S&P Global Manufacturing PMI printed at 57.9 in April, while the services index came out at 56.6. US indexes were xxxxxx

The US will release March Durable Goods Orders, foreseen up 1% MoM, and the preliminary estimate of the Q1 Gross Domestic Product, expected to post a modest 1% gain. By the end of the week, the focus will shift to the core Personal Consumption Expenditures Price Index, the US Federal Reserve’s favorite inflation measure.

Australia will release the Q1 Consumer Price Index, foreseen at 4.6% YoY, much higher than the previous 3.5% and a potential catalyst for an RBA rate hike. On Friday, the country will publish the Q1 Producer Price Index, which is expected to reach 4.2% YoY.

AUD/USD technical outlook

The AUD/USD pair is nearing the 61.8% retracement of the 2022 rally between 0.6966 and 0.7660 at 0.7233. The weekly chart shows that the pair has accelerated its slump below its 100 SMA, while the 20 SMA heads marginally higher around the mentioned Fibonacci support level. Technical indicators, in the meantime, head south within negative levels, with the RSI already below its midline, hinting at a steeper decline ahead.

The daily chart shows that, after failing to overcome its 20 SMA, the pair plummeted, and the indicator turned lower. The pair is also trading below a flat 200 SMA, while the 100 SMA heads marginally higher, a handle of pips below the current level. Technical indicators, however, head lower, almost vertically, nearing oversold readings, reflecting the ongoing slide and hinting at a bearish continuation.

A break below the 0.7230 price zone could lead to a test of the 0.7100 figure en route to the year low at 0.6966. The immediate Fibonacci resistance level is at 0.7315, followed by the 38.2% retracement of the aforementioned rally at around 0.7400.

AUD/USD sentiment poll

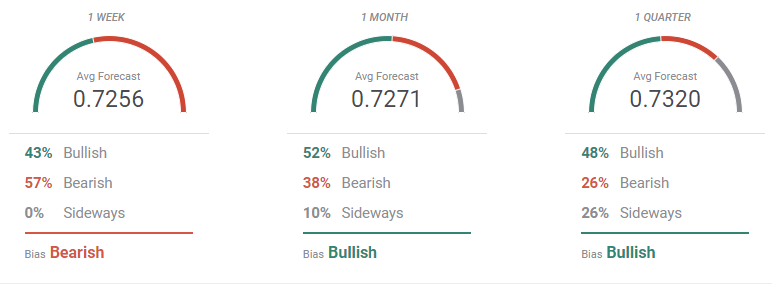

The FXStreet Forecast Poll indicates that AUD/USD could fall in the near term, but the longer-term views are still unclear as there’s just a minor advantage from bulls and the pair is seen seesawing around the 0.7300 figure for the most.

The Overview chart reflects the current negative sentiment, as the weekly moving average heads firmly lower. The one-month moving average is slowly turning south, but overall neutral, while the quarterly one is still flat.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Cardano set for 20% rally as bullish bets increase

Cardano price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.