- Bitcoin Cash price shot up by over 12% in the past seven days, reclaiming the key support level of $231.

- This increase added to the month's rally, bringing the total rise to nearly 28% over the past months.

- BCH investors hold a pretty optimistic outlook despite the lack of price uptick in August, visible in the growth moted in mid-term holders.

Bitcoin Cash price managed to make a good growth over the past 30 days, which is now translating into profits for the investors. BCH holders have maintained a bullish stance since July, which has kept selling to a minimum, contributing to the rise, which is benefitting them in turn.

Bitcoin Cash price nears two-month high

Bitcoin Cash price, trading at $234 at the time of writing, is set to test the support line at $229, following which a bounce back is expected. This is key for BCH to rally up to $253, which is currently acting as a barrier, breaching which would set the altcoin up for reaching beyond $300 to mark new 2023 highs.

Over the past week, the Bitcoin namesake has risen by more than 12%, which contributed to the increase observed in the past month. Up by 22% in this duration, the altcoin has managed to turn all three Exponential Moving Averages (EMAs) into support levels. The Relative Strength Index (RSI), too, is in the bullish zone above the neutral line at 50.0 but has not slipped into the overbought zone above 70.0. This is a bullish sign which suggests the rally might sustain and hold strength to continue further.

BCH/USD 1-day chart

However, on the off chance that investors decide to book profits following this rise, Bitcoin Cash price could decline. Should it lose the support of $229, a fall to the 50-day EMA is likely, losing which would invalidate the bullish thesis and send BCH toward $182.

Selling is unlikely

Bitcoin Cash price dipping due to profit-taking has a much smaller chance of occurring than a decline due to broader market cues. The reason behind this is the optimism observed in BCH holders over the past couple of weeks. Their loyalty towards the altcoin has significantly contributed to the growth noted in the cryptocurrency's price.

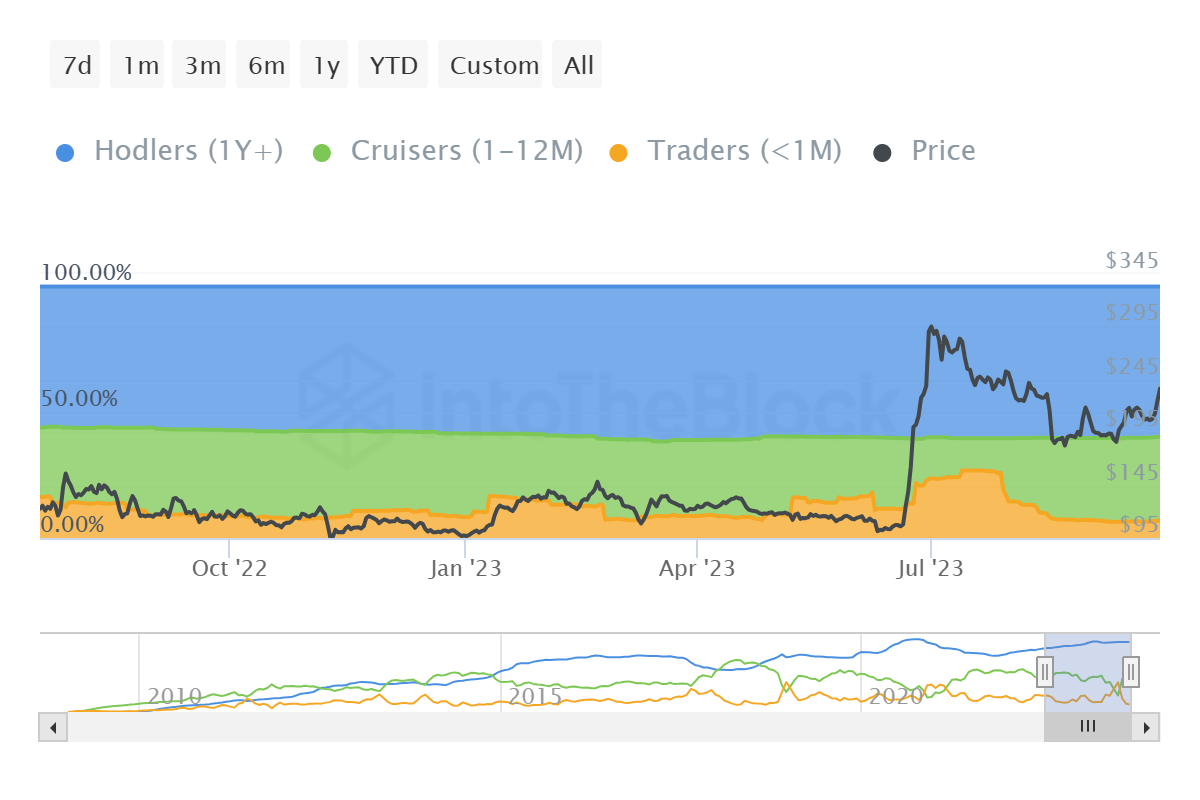

Looking at the distribution of BCH tokens according to time held, it can be observed that in July, nearly 26.5% of the entire circulating supply was held by short-term holders. These investors tend to hold their assets for less than a month.

But starting in August, this concentration decreased, and mid-term holders (investors holding BCH between a month and a year) holdings increased. In the span of two months, this cohort's BCH holding grew from 13% to 33% at the moment. Throughout September, their concentration did not note a decrease.

Bitcoin Cash supply distribution by time

Thus, the short-term traders that matured into mid-term holders exhibit loyalty and bullishness, which is maintained can push Bitcoin Cash price even higher. Furthermore, their sentiment does not exude the willingness to sell, which will also prove beneficial for the altcoin.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.