- The hype around Ethereum ETF, pumped by the SEC’s quick approval, built anticipation that fell flat post-market opening.

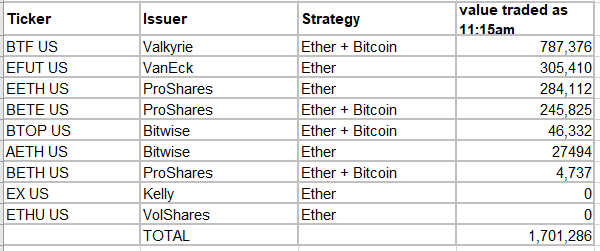

- All ETH ETFs combined generated $1.7 million in trading volume in the first 15 minutes on Monday, amounting to 3.4% of ETH’s trading volume.

- The institutional interest in ETH has been bleak since the beginning of the year, resulting in $114 million in outflows.

Ethereum Futures ETF was anticipated to launch with significant bullishness from investors across the crypto and traditional finance market. The outcome, however, was quite disappointing as the collective slew of ETH ETFs fell short of expectations.

Read more - Grayscale submits request to SEC to turn Ethereum Trust into an ETF

Ethereum ETFs turned out below par

The first few minutes when an exchange-traded fund (ETF) launches are usually critical to gauge whether the investment vehicle delivered on the investors’ interest, and in the case of Ethereum this was disappointing. Following the market opening on October 2, Ethereum Futures ETFs noted no more than $2 million worth of trading volume in the first 15 minutes.

The volume was below average and rather underwhelming when compared to actual Ethereum’s trading volume. In the same duration, the cryptocurrency observed about $50 million worth of trading. Against this figure, the ETH ETFs volume makes up for less than 3.5% of the total ETH traded.

Ethereum Futures ETF trading volume

As highlighted by Bloomberg ETF analyst Eric Balchunas, the ProShares Bitcoin Strategy ETF (BITO), launched in October 2021, observed a trading volume of more than $200 million in the first 15 minutes. This is nearly 9,900% higher than the trading volume generated by all the Ethereum futures ETFs combined today.

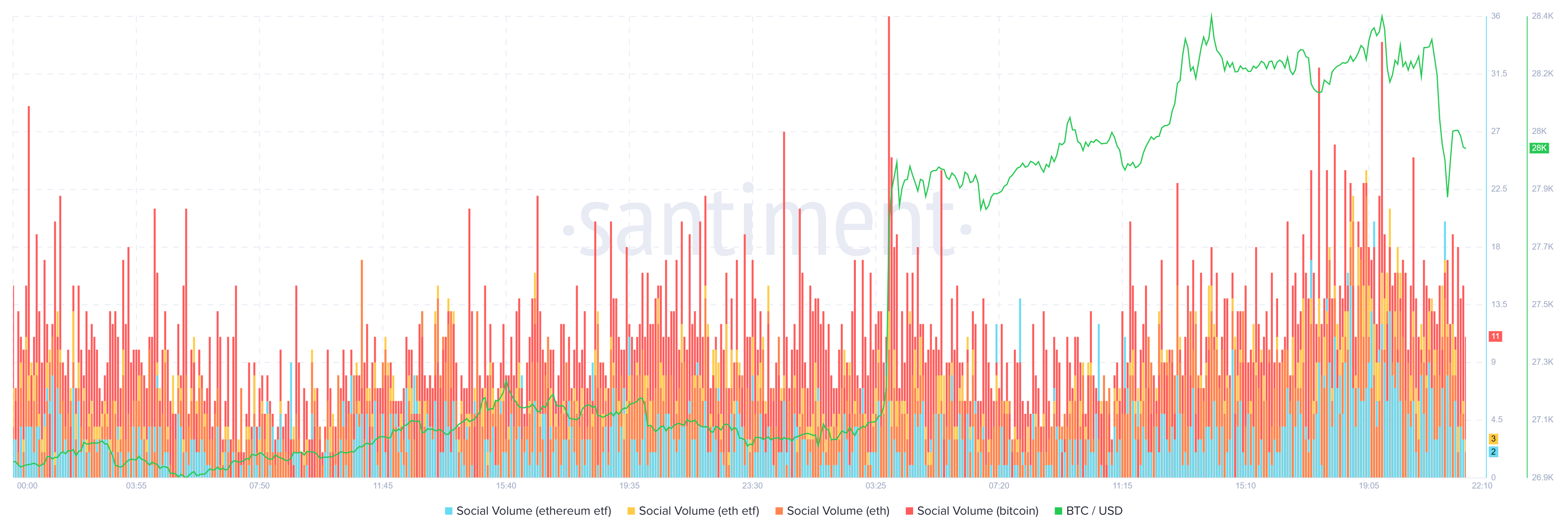

Furthermore, over the past day, the launch of Ethereum ETFs did not observe much interest on social platforms either. To put this into perspective, note that Bitcoin, as a keyword, noted significantly higher social volume than the Ethereum ETF keywords. “Ethereum ETF” accounted for only 1.79% of the entire social volume, while Bitcoin still stood at a solid 4.9%.

Ethereum ETF keyword social interest

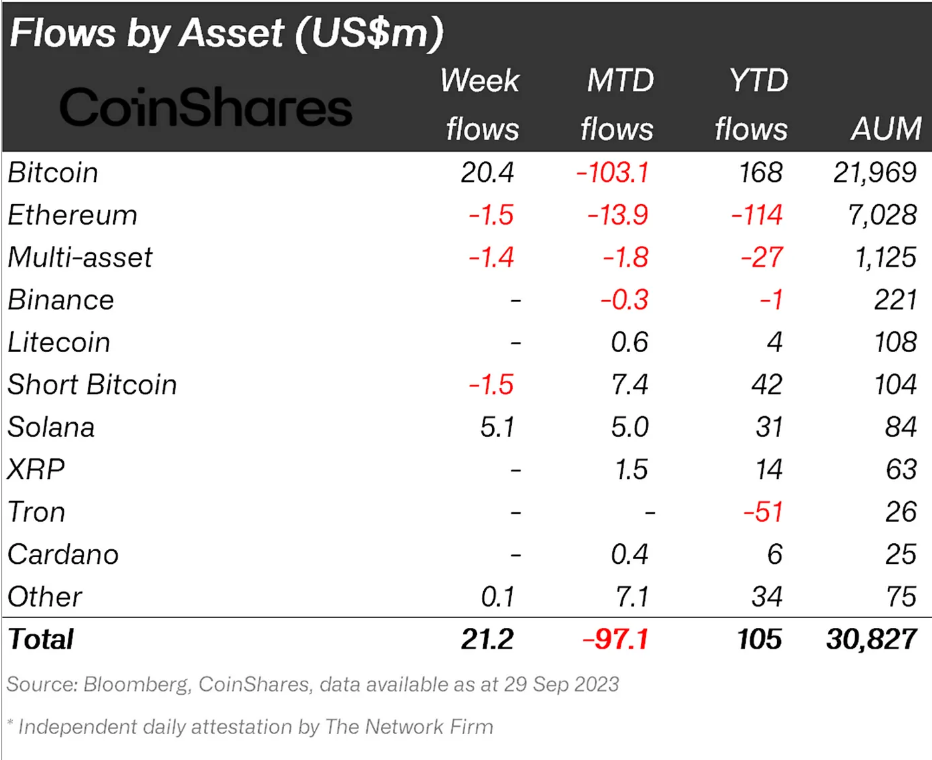

Institutional interest continues to wane

Not only did the cryptocurrency observe a lack of interest from retail investors, but institutional investors also have been sidelining Ethereum since the beginning of the year. As per the CoinShares digital asset fund flow report, ETH has noted more than $114 million in outflows year-to-date, making it the worst-performing asset.

Ethereum institutional interest

Bitcoin, on the other hand, has recorded inflows of $168 million since January 2023 and still added another $20 million in the week ending September 29. Thus, Ethereum is fundamentally losing traction among crypto investors, which might spell trouble for the price going forward.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.