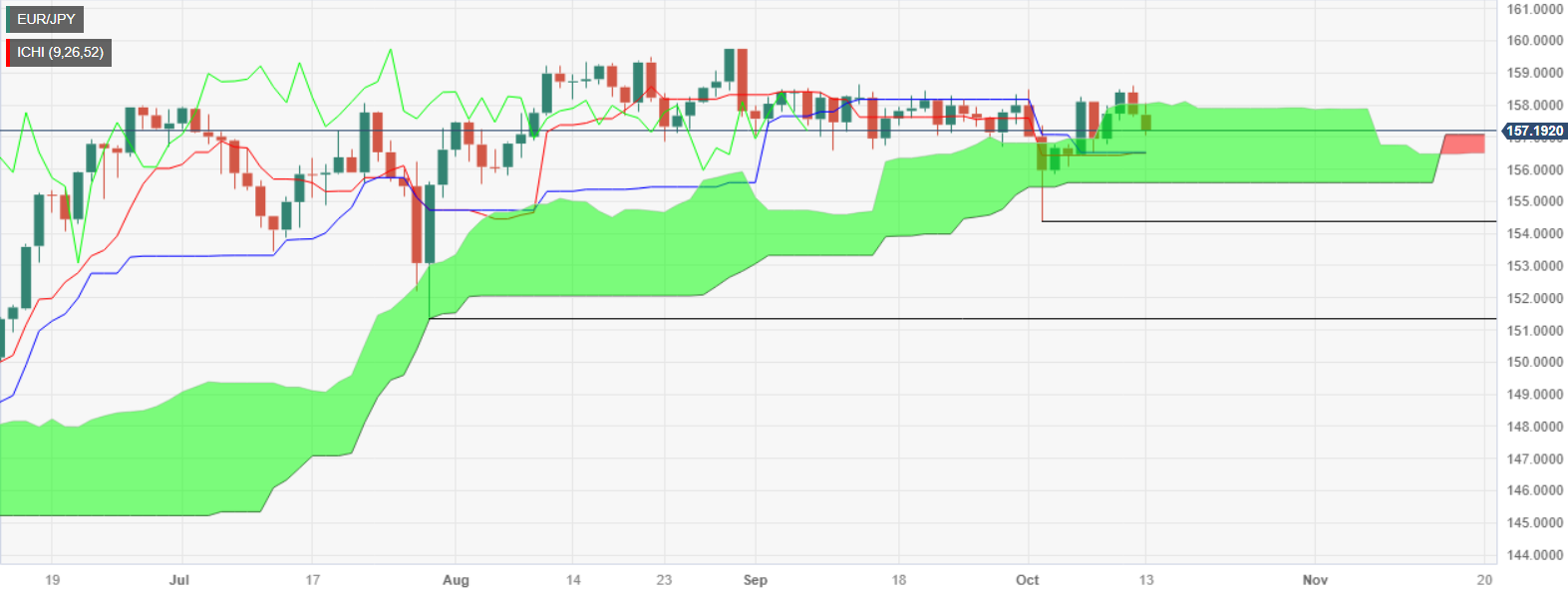

- EUR/JPY slips inside the Ichimoku Cloud after maintaining levels above it for the past three sessions.

- The pair breaches the October 12 low of 157.64, with potential further descent towards crucial support levels identified around 156.49/47, 156.00 mark, and Kumo’s bottom at 155.55/60.

- For upward momentum, the EUR/JPY needs to reclaim the 158.00 level to challenge the top of the Kumo at 158.05/10.

EUR/JPY finally dropped inside the Ichimoku Cloud (Kumo) after flirting during the last three trading days, with the cross-currency pair printing back-to-back days of losses. As we head into the weekend, the pair trades at 157.08, down 0.35%.

The daily chart shows the EUR/JPY drifting lower, below the October 12 low of 157.64, extending its losses toward the figure. A breach of the latter and the cross would drop to the confluence of the Kijun and Tenkan-Sen levels at around 156.49/47, followed by the 156.00 psychological level. If those demand areas are taken, the bottom of the Kumo at 155.55/60, emerges as the last line of defense for bulls before the pair turns bearish.

On the flip side, if EUR/JPY buyers step in, they must claim the 158.00 mark, before cracking the top of the Kumo at 158.05/10. Once cleared, the next resistance would be the October 12 swing high at 158.61, before climbing toward 159.00.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.