- Euro fades the initial hiccup to 1.1060 vs. the US Dollar on Thursday.

- Stocks in Europe close the day with decent gains.

- EUR/USD climbs to multi-day peaks near 1.1065.

- The USD Index (DXY) drops to four-day lows near 101.80

- Final CPI in Italy rose 5.9% YoY in July.

- US headline CPI rose 3.2% YoY in July.

The Euro (EUR) maintains the optimism well and sound against the US Dollar (USD) and prompts EUR/USD to climb further and reach new multi-day peaks around 1.1065 in the wake of the release of US infaltion figures on Thursday. In fact, the increasing risk appetite maintains the downward pressure on the Greenback and provokes the USD Index (DXY) to weaken further and pierce the critical level of 102.00.

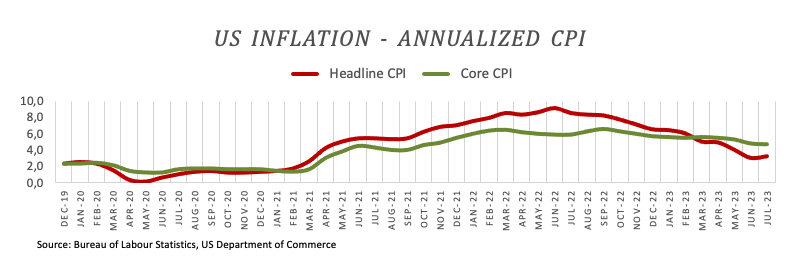

The rise in the pair's value can also be linked to the consistent positive performance of German 10-year bund yields, while the trajectory of US yields appear tilted slightly to the downside. This air of uncertainty in the US money market persists following the release of US inflation figures for July, where the headline CPI rose 3.2% YoY and the Core print gained 4.7% over the last twelve months.

Looking at the bigger picture in terms of monetary policy, there haven't been any significant changes. Investors continue to expect that the Federal Reserve will keep its current interest rates unchanged for the remainder of the year. On the other hand, the European Central Bank (ECB) is currently grappling with internal disagreements within its Council regarding the continuation of its tightening measures post-summer.

Apart from the CPI results in the US economic calendar, Initial Jobless Claims rose by 248K in the week to August 5. Later in the session, speeches by Philly Fed's Patrick Harker, who holds a voting position and is considered a hawkish voice, and Atlanta Fed's Raphael Bostic, another voting member for 2024 who also leans hawkish are also due.

Daily digest market movers: Euro faces extra gains near term

- The EUR gives away some gains vs. the USD post-US CPI.

- The USD Index (DXY) sinks to new lows in the 101.80 zone.

- The appetite for the riskier assets lends extra legs to the pair.

- Italian inflation figures showed the CPI rising 5.9% YoY in July

- Investors remain of the view that the Fed could remain on hold in H2 2023.

- US Inflation figures surprised to the downside in the July.

Technical Analysis: Euro could now accelerate the upside to 1.1150

EUR/USD accelerates the recovery and leaves behind the key barrier at 1.1000 the figure amidst further weakness surrounding the US Dollar.

The continuation of the ongoing bullish move could motivate the pair to challenge the August top at 1.1041 (August 4) prior to the weekly high at 1.1149 (July 27). If the pair surpasses this level, it could alleviate some of the downward pressure and potentially test the 2023 peak of 1.1275 (July 18). Once this region is breached, significant resistance levels become less prominent until the 2022 high at 1.1495 (February 10), closely followed by the round level of 1.1500.

On the other hand, If EUR/USD breaks below the August low of 1.0912 (August 3), it could indicate a potential downward movement towards the July low of 1.0833 (July 6) ahead of the significant 200-day SMA at 1.0766, and eventually the May low of 1.0635 (May 31). Deeper down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Furthermore, the positive outlook for the EUR/USD pair remains valid as long as it remains above the important 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.