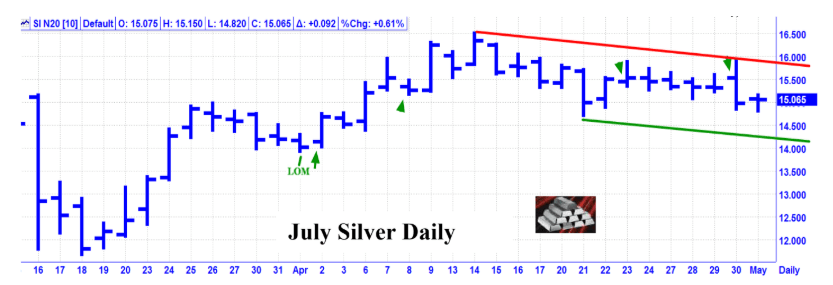

SILVER

April Review Only – “Silver had a March meltdown, reaching the lowest low, since January 2009. Following a good rebound, the market is now trading sideways. Key Dates – 4/2, 4/8, 4/23, 4/30”

Results – 4/2 was very close in price and one day past the low of the month. 4/8 was a good pullback low. 4/23 was a good high. 4/30 was a very good high. Score – 4 out of 4 good dates = 100%.

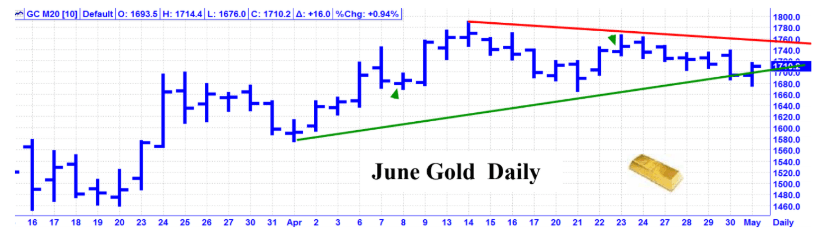

GOLD

April Review – “During March, Gold made its high of the month near the 3/9 Full Moon at Perigee, then plunged more than $200, into a mid-month low. From that low, Gold rallied to near its mid-month high, for a wild roller coaster ride. Key Dates – 4/8, 4/23”

Results – 4/8 was a good pullback low. 4/23 was a good high. Score – 2 out of 2 good dates = 100%.

May Update – The Gold chart looks like Gold is coming to an inflexion point or apex for a wedge or triangle pattern. Whichever way it breaks out, it should be soon, and should generate a substantial move.

Key Dates – 5/5, 5/7, 5/11, 5/22

This is an excerpt from the Astro Trend newsletter. Astro-Trend covers about thirty futures related markets including the major Financial Markets, such as the Stock Market, T-Bonds, Currencies, and most major commodities. We also offer intra day data which identifies potential change in trend points to the minute.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.