- XLM price has taken the lead in recovering losses after the recent market-wide sell-off on August 17.

- Investors seem to be more interested in Stellar’s XLM token after SEC filed a motion that could contest the initial verdict of the SEC vs. Ripple lawsuit.

- If things fall into place, a highly bullish case could see XLM double in value.

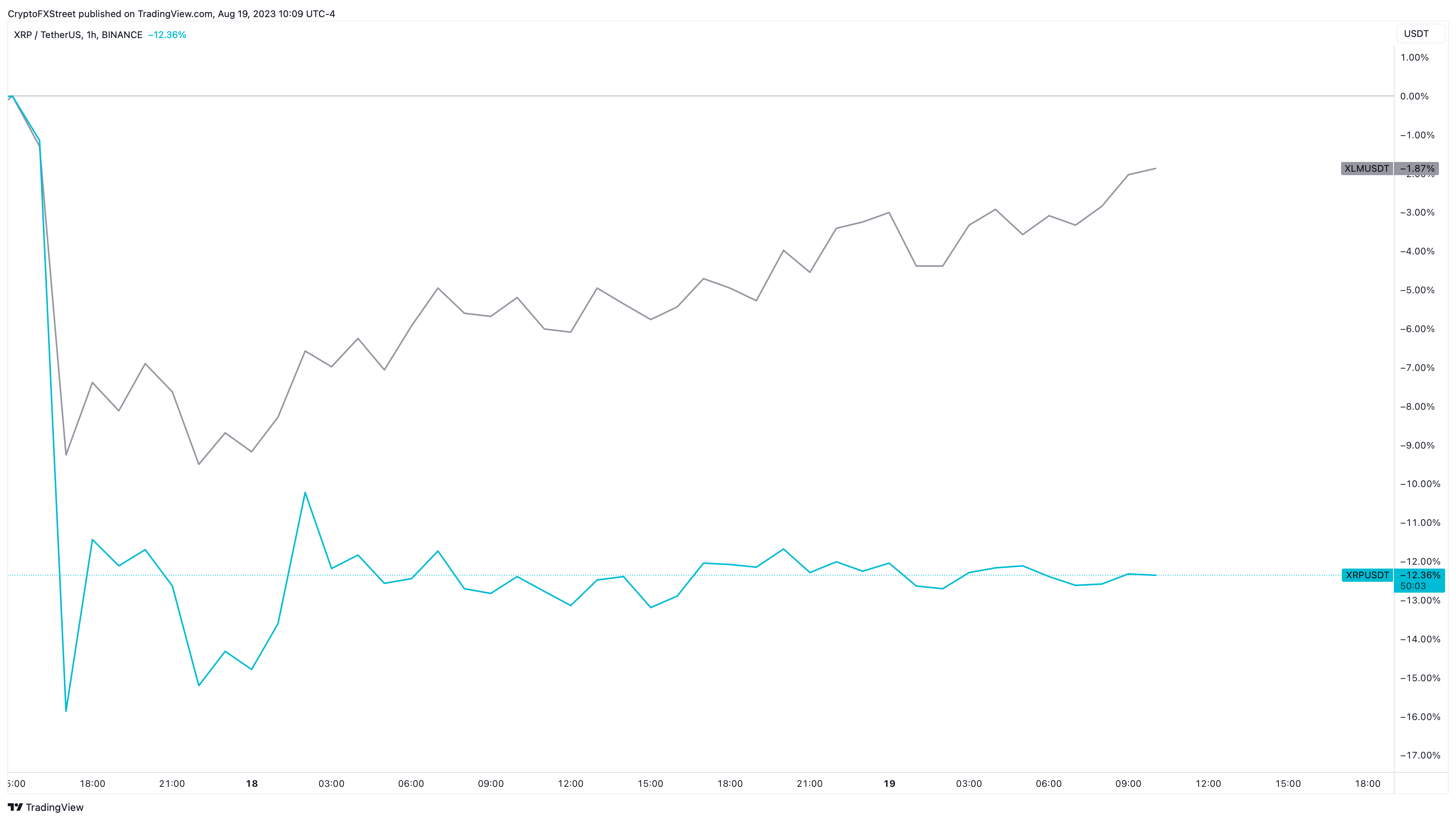

The SEC vs. Ripple lawsuit reached a temporary conclusion on July 13, with a partial win for Ripple. As a result, the XRP price rallied 100%. But now that the US Securities and Commission Exchange (SEC) is back and looking to file an interlocutory motion, the XRP token could be in trouble. The same is already being reflected in the chart, which has propelled XLM to the front.

Read more: SEC vs Ripple, the legal battle intensifies as XRP holders expect new changes from SEC appeal

XLM price takes XRP’s spotlight

XLM price rallied 107% on July 13 after the SEC vs. Ripple lawsuit’s decision was announced. But since then, XLM price has crashed 46% between July 13 and August 17 and currently trades at $0.120. Although the August 17 sell-off knocked the token down by 17%, the recovery rally has yielded nearly 17% gains for bottom buyers.

XRP price suffered a more fatal blow than XLM on August 17, losing 28% of its value. But the remittance token has recovered nearly 18%, trading at around $0.506.

A comparison of the two shows that the XLM price is already at pre-crash levels while the XRP price is struggling.

XLM vs. XRP price performance

Also read: Can Shytoshi Kusama’s plan to revive Shibarium undo Shiba Inu price losses?

Stellar’s XLM token could rally another 100% if BTC aligns

Stellar’s XLM price currently hovers around $0.121 after recovering 15% from the August 17 bottom at $0.105. If XLM price manages to recover above $0.127, it will signal a comeback from bulls and potentially propel Stellar by 37% to tag the next critical level at $0.166.

In a highly bullish case, XLM price could retest the $0.239 barrier, resting above which is buy-side liquidity. A sweep of this level seems likely, especially considering the Relative Strength Index (RSI) and Wave Trend indicator, hinting at a potential reversal.

The RSI indicator bounces from the oversold zone, while the Wave Trend indicator contemplates a bullish crossover. The last time this happened, XLM price rallied 55% in roughly three weeks.

In addition to the bullish technicals, if SEC does proceed with the appeal and finds success, it could give XLM the upper hand.

XLM/USDT 1-day chart

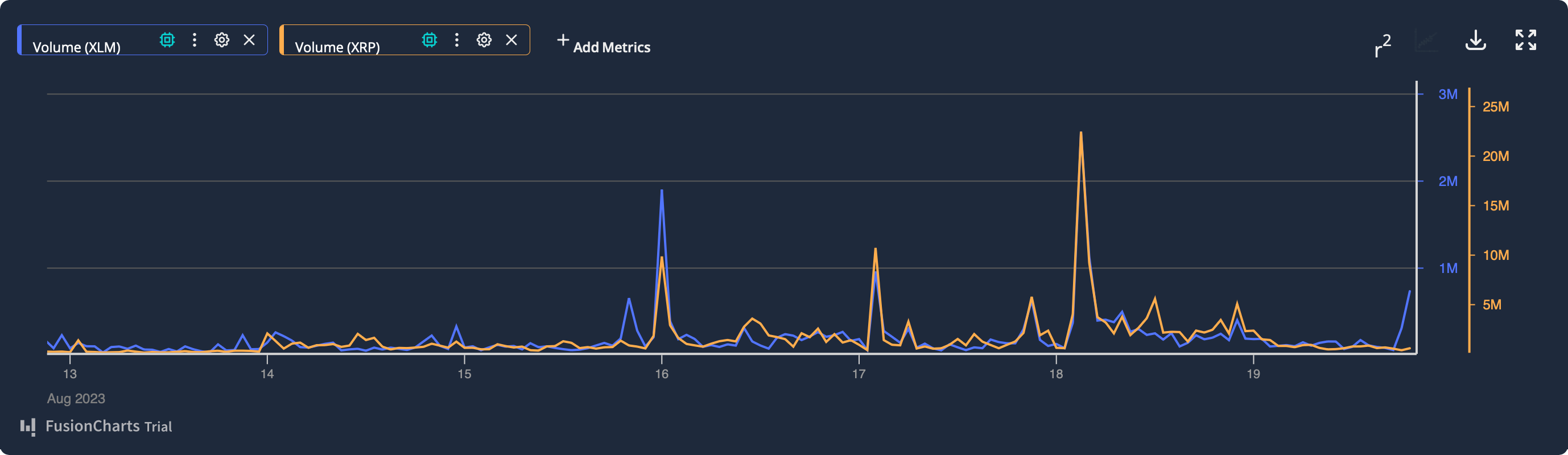

According to the data analytics platform Chain of Demand, the volume for XLM as of August 19 hit $734,000, while XRP’s hovers around $597,000. This sudden uptick further explains why XLM has a better chance of recovering from the slumps and also adds credence to the bullish thesis for Stellar.

XLM vs. XRP volume chart

On the other hand, if XLM price breaches the $0.104 support level, it will create a lower low and invalidate the bullish thesis. Such a development could attract Stellar holders to sell, further triggering a 15% crash to the next stable support floor at $0.0949.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.