If it flies like an airplane, looks like an airplane, sounds like an airplane, it’s probably not a pigeon. No matter what the experts on airplanes and pigeons say. Even if someone wins a Nobel Prize because they have determined that a pigeon is actually a dinosaur based on a sophisticated mathematical equation, it’s still a pigeon. Adam Smith, whom many call the father of economics, laid out the ground rules for Supply and Demand hundreds of years ago. In his book, The Wealth of Nations, supply and demand is explained in very simple terms. Smith however didn’t invent supply and demand, it has been here all along and, guess what, it hasn’t changed; it never changes. When price is at a level where willing demand exceeds willing supply, price will rise. When price is at a level where willing supply exceeds willing demand, price will decline.

Over the centuries certain big name self-promoting economists have tried to twist this simple equation with fancy math to make a name for themselves, sell some books and win fancy prizes, only to eventually be proven dead wrong. The math works but it’s the old garbage in garbage out.

Just like gravity is always gravity, there are certain principles of how the world works that NEVER change. In our world of proper trading and investing, the only way to profit consistently is to buy low and sell high. This is how you make money buying and selling anything. A successful business buys or produces at whole sale prices and sells at retail prices. Good news, this is exactly how the profitable market speculator does it as well.

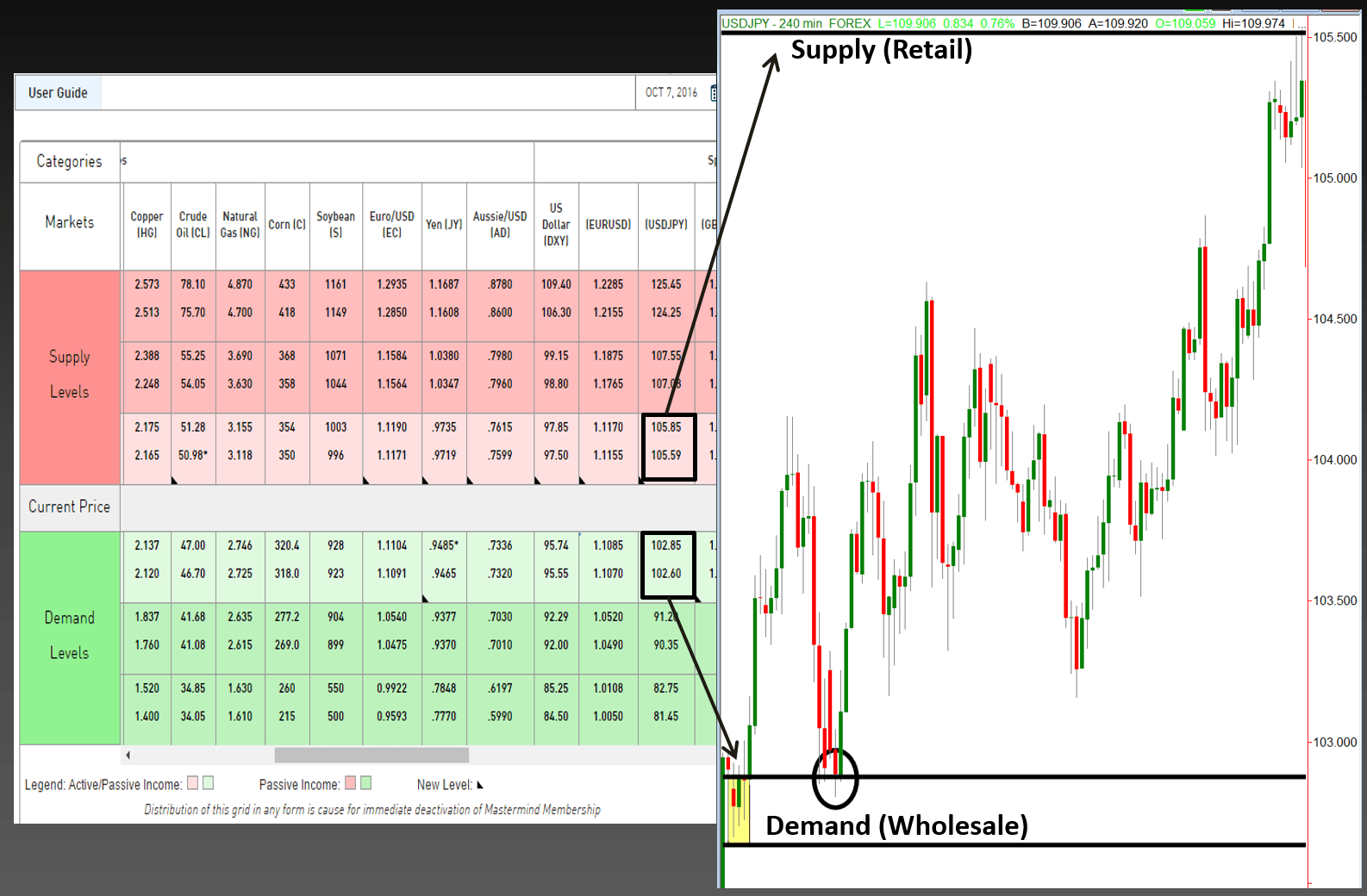

OTA Supply / Demand Grid – USDJPY

Using the time honored principle of supply and demand, this market opportunity was to buy the USDJPY at 102.85 with a target of 105.59. In other words, at a “fresh” demand level in the USDJPY. Price had been declining and was nearing the demand zone on the chart. Three weeks later price reached our supply zone, profit target. As I said above, another word for demand is “wholesale”. So, when price reached that wholesale level, we want to be an aggressive buyer. Who are you buying from? You’re buying at wholesale levels from people who are trained and comfortable selling at wholesale levels. Why would someone sell at wholesale levels? They obviously don’t understand that proper trading is no different than how the gas station profits on chewing gum. They buy the gum for $0.05 and sell it to us for $1.00. They just keep repeating that simple process over and over. If they sold the gum for $0.05 and bought it for $1.00 two things would happen. First, they would have plenty of very happy customers who love them (the buyers). Second, the gas station would soon be out of business.

If your having issues with trading and investing and ready to pull your hair out with frustration, perhaps your complicating something that is actually quite simple. Maybe your trying to turn the reality of how markets really work into a way that they don’t. Maybe your really just looking at an airplane, thinking it’s a pigeon. Its an airplane, don’t overthink it…

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.