Chaos Clinic for 5/1/2020

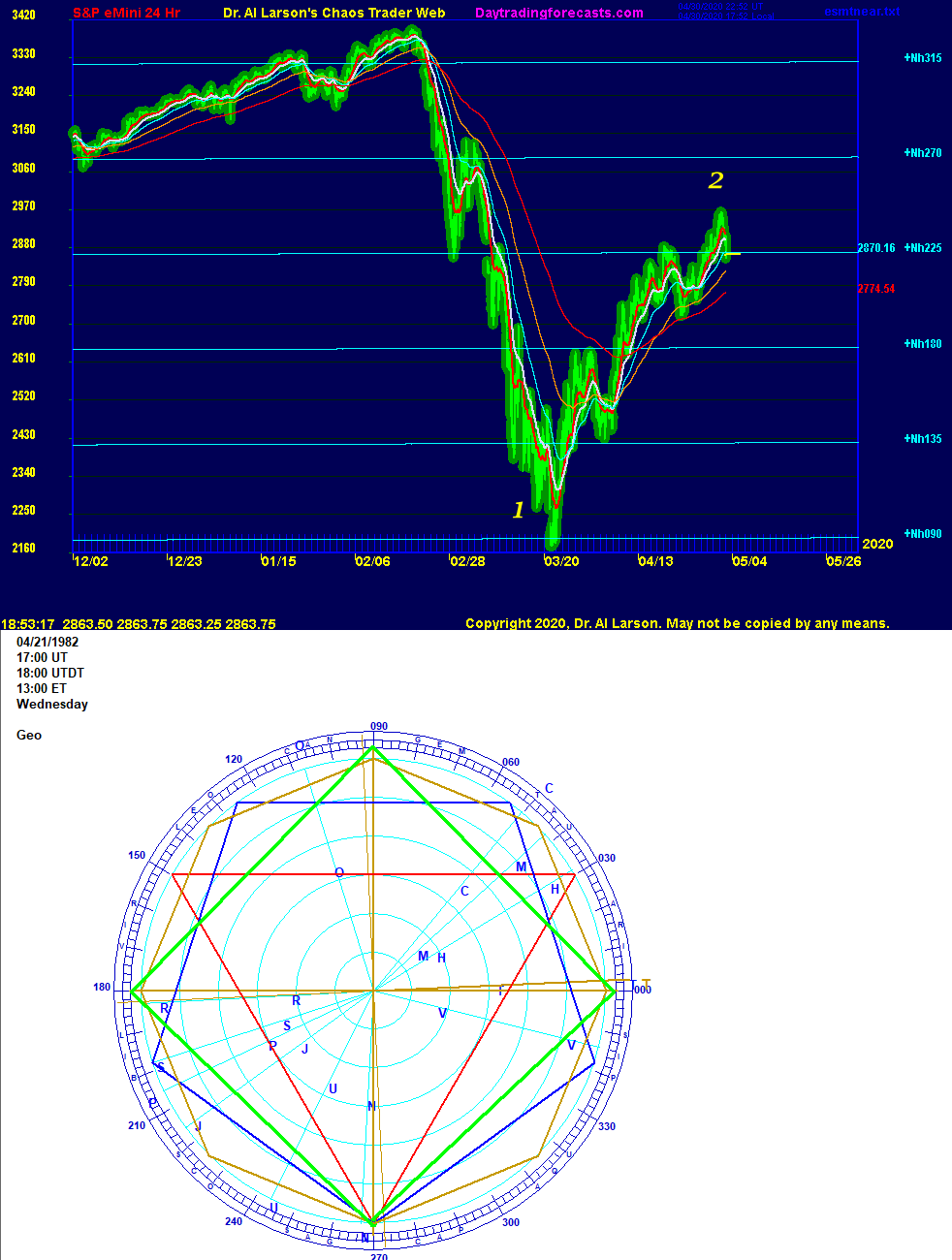

The top chart shows a plasma chart of the S&P, overlayed with heliocentric Neptune flux lines.

The flux lines are plotted every 45 degrees using a Wheel of 1800 scale. This scale is 5 times the Wheel of 360 scale that existed before COVID-19.

Markets have a "fractal fuzziness." Underlying that is a harmonic structure based on integer ratios. This shows up in this chart in the retracement ratios. The move 2 retracement was .642, a bit beyond the Fibonacci .618.

But in terms of the Neptune levels, the decline was down 5, up 3, the ratio of two integers, 3 and 5. The Fibonacci series is a seriesof intergers, starting with 1,2,3,5, and 8. So a a 3:5 ration fits. Energy adds together in integer ratios.

So why would Neptune electric field flux show up so strongly in the S&P? The answer is in the second chart, which is a natal ephemeris wheel for the S&P.

Neptune is very near the cardinal 270 degree position. Using this as a common point, there are harmonic relationships with several other natal planets.

Natal Sun is trine natal Neptune (red). Mars and Moon are square to it (green). Venus, Chiron, and Saturn are pentile to Neptune (blue). And Mercury is octile to Neptune. This octile creates frequency doubling with the square. Frequency doubling is a precursor to Chaos.

On the top chart, the Nh+315 level is 180 degrees to natal Mercury. The low of Nh+090 is natal Moon. The current Nh+225 is Mh+090. The intermediate level of bNh+135 is Mh+000, while the Nh+180 is both Tn+090 and Rn+270. So with the help of the plasma chart, which helps show the "fractal fuzz" and the ephemeris, the harmonic structure underlying the chaos is revealed.

The top chart looes like moves 1 and 2 of 7 in a down Chaos Clamshell.

This content was published on Dr. Al Larson's Chaos Clinic which you can attend each Friday for free.

Dr. Al Larson has developed a complete Chaos Model of Markets, four unique courses that let you become a Certified Chaos Trader, some very unique eMylar fractal pattern overlays, and tools that permit forecasting individual stocks and markets years in advance. You can also sign up for a free weekly email, and attend a free Chaos Clinic on Fridays. To learn more, click on the author's profile.

Be sure to sign up for the free weekly email!

Information on this page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these securities. You should do your own thorough research before making any investment decisions.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.