“When they formed the Euro, I told them “You have to consolidate the debt”. They felt they couldn't sell that idea to the Europeans. So they wanted to go through the currency first and then they would deal with the debt. And that never happened. […] Now they keep yelling at Greece: “You've got to pay, you've got to pay”. The whole Euro depends upon countries that can't pay. And if they break, everybody will going to start and sell the Euro because the whole system is just completely bogus! […] The Euro is in serious trouble and Brussels does not understand what the problem is. Politicians do not understand currency.”

Martin Armstrong, once a financial strategist and advisor to over one trillion dollars of asset, developed a computer model based on the number Pi and other cyclical theories to predict economic turning points with eerie accuracy.

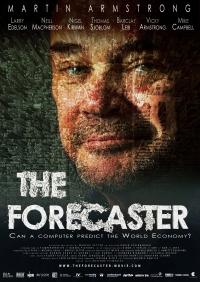

Just recently, Martin came to Barcelona for a festival screening of the documentary movie "The Forecaster", directed by Marcus Vetter, about his experiences with the New York banking cartel.

We had the rare privilege to receive Martin in our offices and took the opportunity to ask for his view on many troubling issues involving money and financial markets. We purposely took a different angle from the film's, not inquiring Martin about the injustice he and his family had to go through in recent years, and instead tried to plunge into the mind of an individual who discovered how the world ticks through the lens of a computer model.

We listened him talking about gold standards, interest rates, what money really is, the Euro and European debt, Grexit, taxation, the Swiss peg, oil, stock markets, elimination of cash, and many more fundamental topics of today's world economy.

Money flows between stocks, bonds or commodities, political circumstances and economic trends, the variables are just too many for a human mind to process it all into a lucid forecast. You may agree or disagree with Marty's political stance, but you can not deny the fact that history keeps repeating and each generation has to learn a hard lesson.

The talk is of high interest for any citizen of the world but becomes even more compelling for currency traders, since misunderstanding currency makes us blind to the perpetual dance between value and price across the globe.

We hope you'll enjoy watching this eye-opening video as much as we enjoyed talking with Martin.

Behind the scene: How FXStreet met with Martin Armstrong

Video Player:

Our video is available in HD but if your internet connection or device does not support such a heavy file, you can reduce the resolution of the video:

• Click on "Play" then on the gear at the right bottom corner of the player ("Settings")

• Next to "Quality", choose the resolution of the video.

---

Interview conducted by Gonçalo Moreira

Recorded at FXStreet's headquarters in Barcelona on May 28, 2015

Video edited by Maud Gilson

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.