AUD/USD

AUDUSD extends steep fall into second consecutive day and hit new lowest in eleven months in early Tuesday.

The pair was down 0.8% in Asian / early European trading on Tuesday, in extension of Monday’s 0.93% drop, signaling bearish continuation after limited correction.

Australian dollar is pressured by strong US dollar on expectations that the Fed will keep high interest rates for longer period, while policy decision of Reserve Bank of Australia was a key driver this morning.

The RBA kept its interest rates unchanged at 4.1% for the fourth month and said that recent rather positive economic data suggest that things are moving in desired way, though did not rule out further tightening, if needed.

Today’s decision also negatively influenced expectations for rate hike in November, dropping bets from initial 44% to 36%, which may further deflate Aussie dollar.

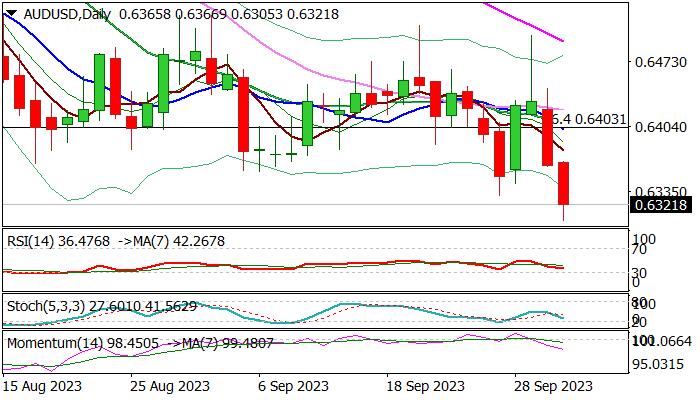

Daily studies remain firmly bearish, though fresh bears need close below last week’s low at 0.6331 to confirm signal and open way for extension towards targets at 0.6300/0.6272 (psychological / Nov 11 trough) which guards key support at 0.6170 (2022 low).

Limited corrections should be capped under broken Fibo 76.4% at 0.6403 (reinforced by 10DMA) to keep bears intact and provide better selling opportunities.

Res: 0.6357; 0.6378; 0.6403; 0.6444.

Sup: 0.6305; 0.6300; 0.6272; 0.6210.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.