-

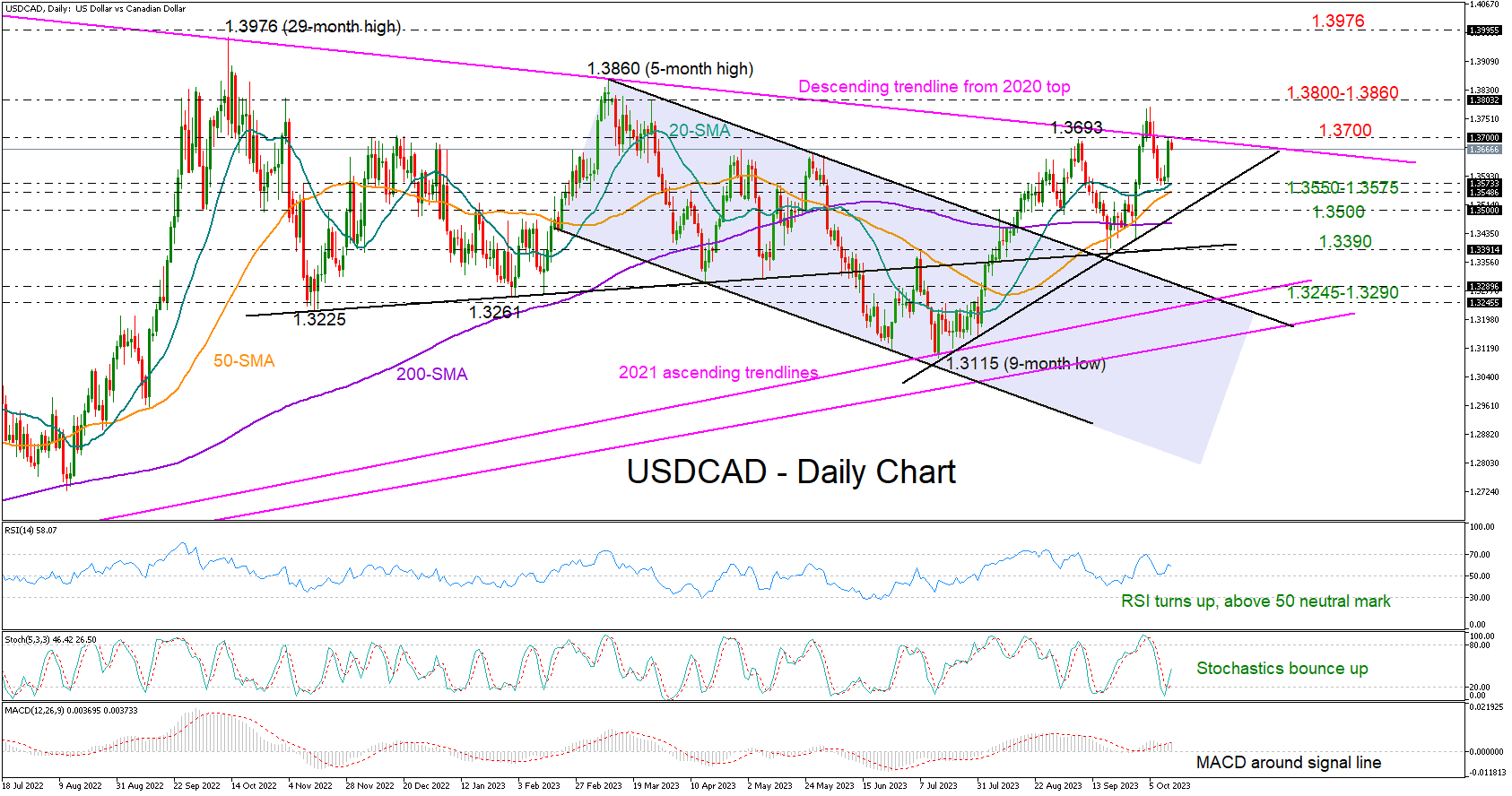

USDCAD treats its wounds with solid bounce.

-

Caution needed as familiar resistance nearby.

USDCAD gathered significant momentum on Thursday, flipping weekly losses into a 0.20% gain after a slightly stronger US CPI report.

The pair kept its footing above its simple moving averages (SMAs), but the descending trendline from the 2020 top resumed its resistance role, halting the bullish action marginally below 1.3700. Despite some positive signs coming from the RSI and the stochastic oscillator, the bulls need to break through that threshold to move towards the 2023 wall of 1.3800-1.3860. The 2022 peak of 1.3276 could be the next destination.

On the downside, the 20- and 50-day SMAs could hold the market above the short-term support trendline drawn from July near 1.3500. Note that the 200-day SMA is flattening in the same region. Hence, a step lower could trigger another negative correction towards the support line from November at 1.3390. Failure to bounce there could squeeze the price into the 1.3245-1.3290 zone, where the upper band of the broker bearish channel intersects the 2021 ascending trendline.

In brief, the recent solid rise in USDCAD looks appealing, but it may not last if it can't run sustainably above 1.3700.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.