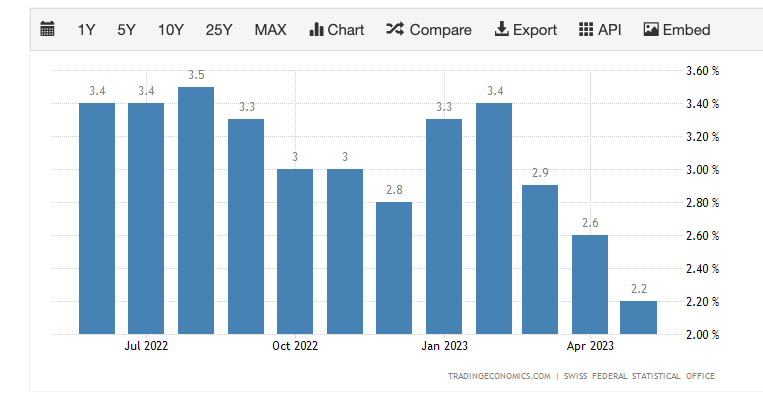

Last week the SNB increased inflation to 1.75% from 1.50% and signaled that further rate hikes were likely. Headline inflation in Switzerland is the second lowest in the G20 at 2.2% y/y.

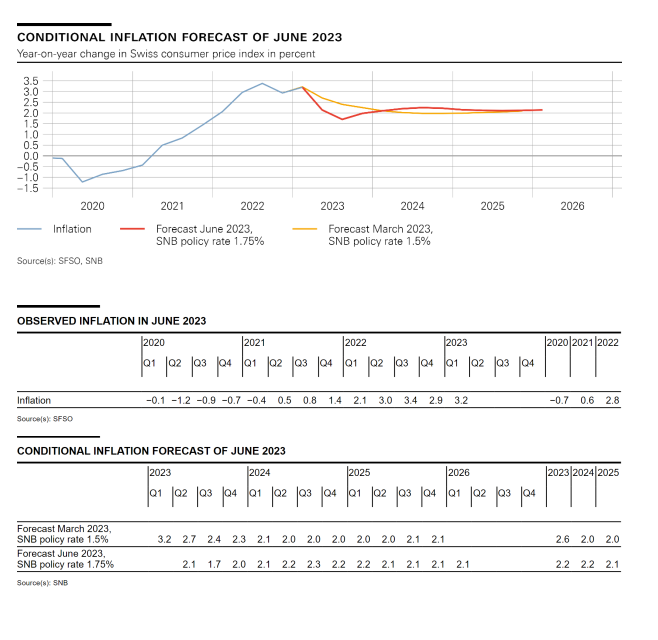

However, although the SNB acknowledged this falling inflation it was mainly attributed to lower inflation on imported goods, mainly oil products and gas.

Inflation fears

With average annual inflation projected at 2.2% for 2023 and 2024, and 2.1% for 2025, the SNB believes the battle against inflation is far from over. The next interest rate meeting on September 21 is expected to result in a 25 bps hike to 2.00%. Short-term interest rate markets anticipate a terminal rate of 2.12%, indicating optimism that the SNB is approaching the peak of its rates.

Rate expectations from here

The next interest rate meeting for the SNB is on September 21. Expectations are that the SNB will hike by 25 bps to 2.00%. Short-term interest rate markets see a terminal rate of 2.12%, which is lower than before the SNB meeting. So, rate markets are happier that the SNB is closer to reaching the peak of their rates.

What does this mean for the future?

Keep a close eye on incoming inflation data as it holds significant importance for the SNB’s rate policy. Higher-than-expected inflation could boost the Swiss franc (CHF) as markets anticipate higher rates. Conversely, a sharp decline in inflation data may lead to CHF depreciation, as hopes arise that the SNB will not need to hike rates again in September. Stay alert to incoming inflation data!

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure. *Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.