-

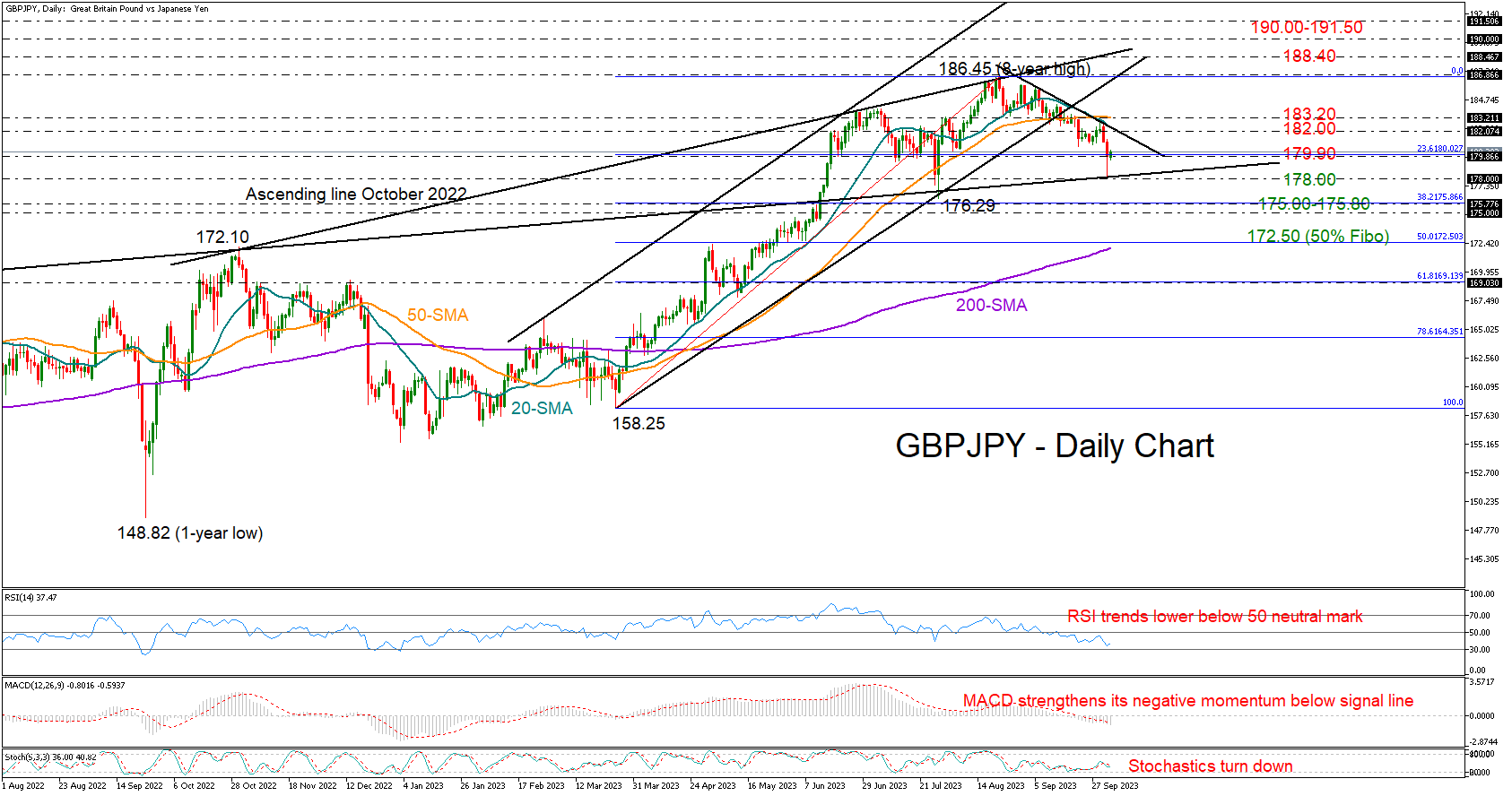

GBPJPY finds support after sudden fall, but risks remain.

-

Bearish wave could gain new legs below 178.00.

GBPJPY slumped suddenly to 10-week low of 178.00 on Tuesday in what looked to be a currency intervention from the Bank of Japan.

The resistance-turned-support trendline from April 2022 halted the bearish action and lifted the price back to the 179.90 constraining area, but downside risks have not evaporated yet.

The RSI remains negatively charged comfortably below its 50 neutral mark, while the stochastic oscillator has resumed its negative momentum. Meanwhile, the decline in the MACD has picked up pace below the red signal line, suggesting downside pressures may dominate in the short-term.

Should sellers drive below 178.00, the pair might seek shelter within the 175.00-175.80 area, where the 38.2% Fibonacci retracement level of the 158.25-186.45 uptrend is found. A step lower could stretch towards the 50% Fibonacci of 172.50 and the 200-day simple moving average (SMA). If buyers don’t show up there, the bearish wave could strengthen towards the 61.8% Fibonacci of 169.00.

On the upside, the 20-day SMA and the short-term resistance trendline drawn from recent highs could cancel any progress around 182.00. The 50-day SMA could cement that ceiling, preventing a quick rally towards the eight-year high of 186.45. Slightly higher, the bulls could face a noisy trading around the resistance line coming from October 2022 at 188.45. If this proves easy to overcome, the door will open for the 190.00 psychological mark and the 191.50 barrier from 2015.

In summary, GBPJPY bears might have some extra fuel in the tank, with traders expected to engage in new selling tendencies below 178.00.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.