- Economists expect the ISM Services PMI to slip to 53.6 points, still reflecting moderate growth.

- Recent patterns imply a greater miss in the data for America's largest sector.

- Without a drop under 50, the US Dollar will likely emerge as winner after the initial drop.

What goes up must come down – that adage has been relevant to the ISM Services Purchasing Managers' Index (PMI) in the past six months, with data zigzagging between beats and misses. Even if this forward-looking indicator misses estimates in the release for September, any US Dollar selling will likely be temporary.

Here is a preview of the ISM Services PMI, due on Wednesday at 14:00 GMT.

ISM Services PMI recent developments and market impact

Services consist of the vast majority of the US economy, the world's largest, and this survey of purchasing managers serves as a leading indicator of economic activity in the sector. It is also a hint for Friday's all-important Nonfarm Payrolls.

In recent months, Federal Reserve (Fed) officials have been beating the drum of data dependency – and investors have been reacting to every economic figure, whether it is hard data or soft data, such as the ISM Services PMI survey.

The sector has been growing at a satisfactory pace in the past year. According to ISM, expansion – or a score above 50 – was seen in 11 out of 12 months, but this does not mean stability. Economists struggled to follow the twists and turns in the sector.

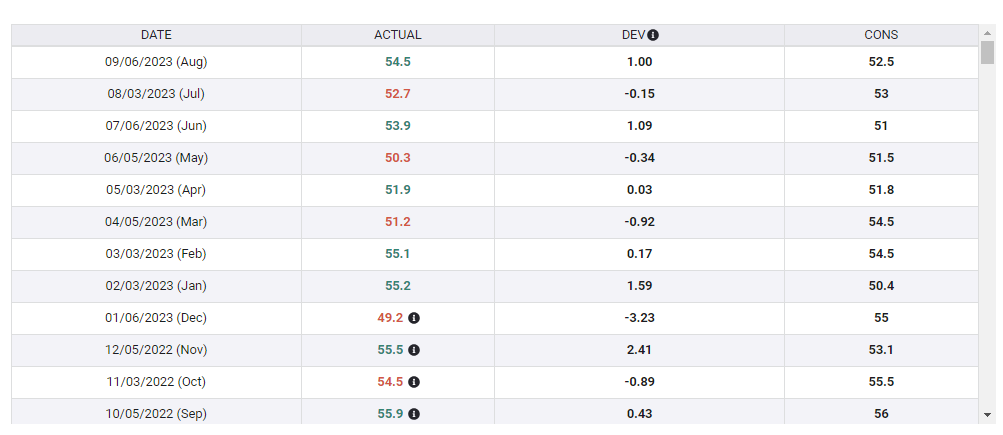

ISM Services PMI. Source: FXStreet

Data has been bouncing between beats and misses in the past few months. After exceeding estimates in August, a disappointing figure for September would continue this pattern. Expectations are relatively modest – a score of 53.6 from. 54.5 in August.

If the pattern fails to hold and ISM Services PMI beats estimates, the trend of US Dollar strength will likely extend. The economy is doing well, and investors fear the Federal Reserve's hawkish intentions.

Assuming the zig-zag pattern holds, there is room for limited US Dollar selling. Unless America's largest sector slips into contraction according to this indicator, any dip in the Greenback could prove a buying opportunity. The world's largest economy leads a globe that is struggling to expand.

For Gold and stocks, a small miss would serve as a selling opportunity.

Final thoughts

The ISM Services PMI is the last significant indicator before the Nonfarm Payrolls – and a substantial market mover when published after the jobs report. It is set to rock markets, and unless the outcome is a disaster – highly unlikely given recent US economic strength – a "buy the dip" opportunity on the Greenback is likely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.