-

Stellar year for Swiss franc, tied for best-performing major currency.

-

End to negative rates, FX interventions, and safety flows helped.

-

Next week's SNB decision and risk tone could decide franc's fate.

Flying under the radar

Even though it hasn’t attracted many headlines, the Swiss franc has gone on a silent winning streak. It is virtually tied with the British pound as the top-performing currency of this year, while it has gained more than 3% against both the US dollar and the euro. Against the bruised Japanese yen, the franc has appreciated by around 15%, pushing the franc/yen cross to new record highs.

Several elements lie behind this impressive performance. First and foremost has been the Swiss National Bank’s exit from negative interest rates. With the central bank raising rates back into positive territory, global depositors are no longer penalized for parking their cash in Switzerland.

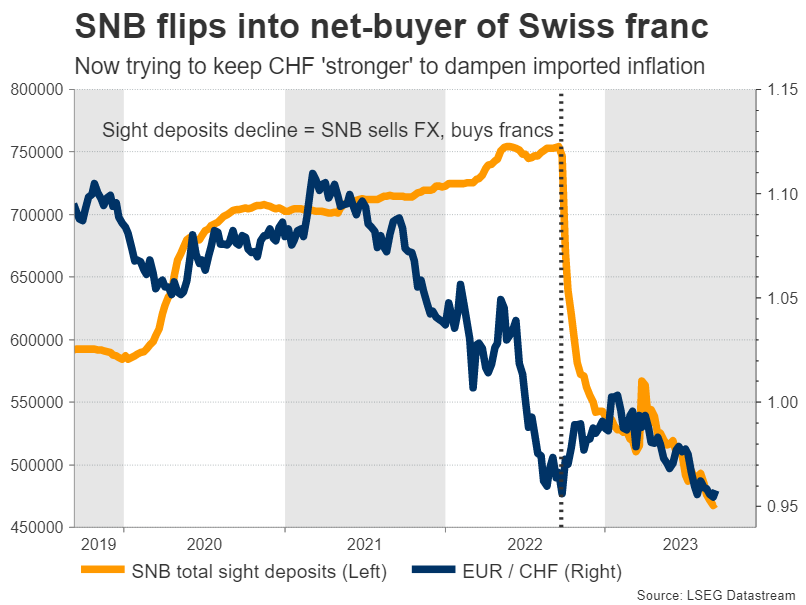

Direct FX interventions have also played a role. The SNB has been active in the currency market for a long time, but last year it flipped from a net-seller of francs to a net-buyer, in an attempt to strengthen the currency and exert downward pressure on imported inflation.

This can be seen through sight deposits at the SNB, which are considered a proxy for foreign currency purchases. Sight deposits have fallen sharply over the past year, revealing that the central bank has been actively selling foreign currencies and buying francs on the open market.

A quiet flight to safety likely helped the franc too. Because of Switzerland’s chronic current account surplus, the franc often acts like a safe haven instrument, especially when the Eurozone economy encounters trouble. With business surveys warning the Eurozone is headed for a mild recession, this dynamic probably came into play.

What’s next? All eyes on SNB

Looking ahead, there are both positives and negatives on the horizon. Arguing in favor of further franc gains is the worsening economic data pulse in Europe and China, which might continue to fuel safe-haven flows.

Any correction in high-flying US stock markets could have similar effects. That’s a real risk considering that equity valuations are stretched, earnings have been stagnant for three quarters now, and bond yields are trading near their highest levels of this cycle.

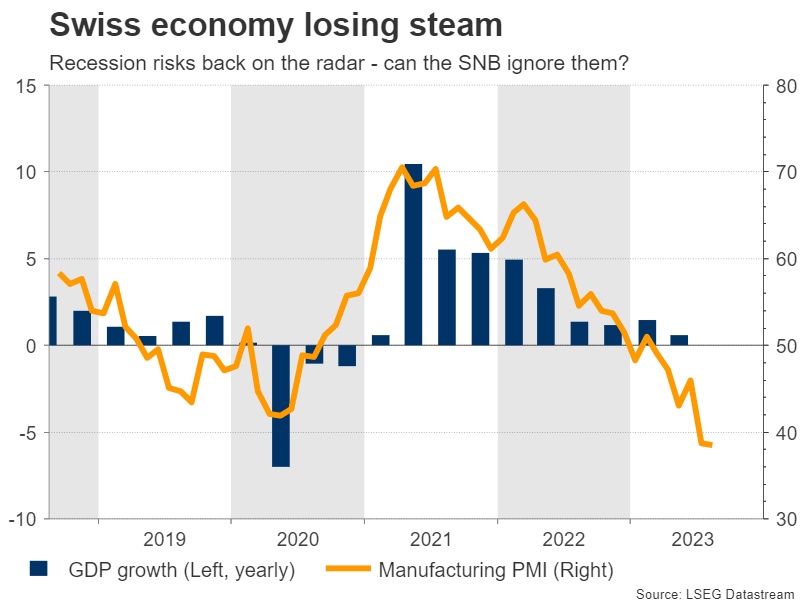

However, the Swiss economy has also started to lose steam, which in turn might give the SNB cold feet. In the second quarter, GDP growth was running at just 0.5% from a year ago, slowing down sharply as the stronger franc dampened demand for exports and capital investments stalled.

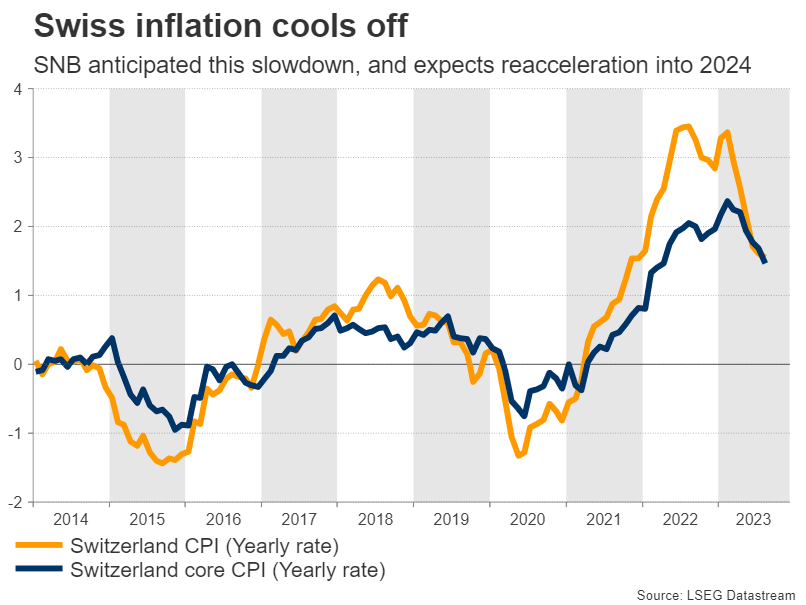

Similarly, inflation has cooled off. The yearly CPI rate clocked in at 1.6% in August, staying below the central bank’s 2% target for a third month. That said, the SNB anticipated this cooldown in its latest forecasts and still maintained a tightening bias, warning that inflation would reaccelerate next year because of higher electricity and rent prices.

Therefore, the immediate question facing the franc is whether the SNB will raise rates next week. Growth is losing power and recession risks cannot be ignored based on global trends, but at the same time, the recent spike in energy prices could make the SNB even more concerned about stubborn inflationary pressures.

That leaves the SNB with a difficult choice: keep rates unchanged to safeguard economic growth or raise them to eradicate inflation? Market pricing is currently leaning towards no action, assigning a 60% probability for the SNB to pause next week versus 40% for another rate hike.

Whether the European Central Bank raises rates on Thursday will be a key variable in this decision. The SNB usually follows in the ECB’s footsteps, mimicking the moves of its larger neighbor so that interest rate differentials don’t widen too much and put pressure on exchange rates.

Speaking of exchange rates, the SNB’s stance on FX interventions needs to be monitored closely. For now, the SNB is buying francs to dampen imported inflation, but that could change if inflation doesn’t reaccelerate. It’s probably too early for such a shift next week, but it’s a clear risk moving forward.

Big picture

Blending it all together, the franc’s fortunes will be tied mostly to FX interventions and the global economy. With global growth slowing while the SNB continues to boost the franc through interventions, the near-term landscape seems favorable, even if there is a setback next week in case the SNB holds rates steady.

That said, the franc’s performance will also depend on the currency it is matched against. For instance, the franc could outperform the growth-starved euro, and might also outshine the yen, which has been decimated by Japan’s refusal to abandon negative rates.

The catch is that the franc might struggle to record any further gains against the US dollar, which is backed both by a resilient economy and safe-haven qualities. A period of risk aversion in global markets would benefit both currencies, so the deciding factors might be interest rate and growth differentials, which seem to favor the dollar.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.