- Nonfarm Payrolls in the US are forecast to increase by 170,000 in August.

- Gold is likely to react slightly stronger to an upbeat jobs report than a disappointing one.

- Gold price's inverse-correlation with NFP surprise weakens slightly by the fourth hour after the release.

Historically, how impactful has the US jobs report been on gold’s valuation? In this article, we present results from a study in which we analyzed the XAU/USD pair's reaction to the previous 35 NFP prints*.

We present our findings as the US Bureau of Labor Statistics (BLS) gets ready to release the August jobs report on Friday, September 1. Expectations are for a 170,000 rise in Nonfarm Payrolls following the weaker-than-expected 187,000 increase recorded in July.

*We omitted the NFP data for March 2021 and March 2023, which were published on the first Friday of April, due to lack of volatility amid Easter Friday.

Methodology

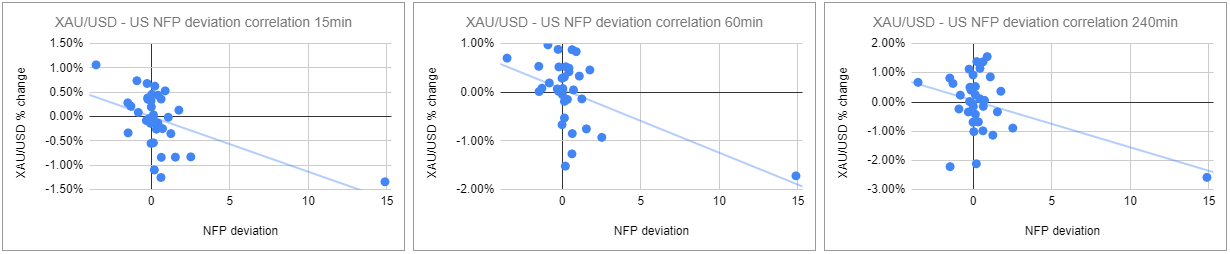

We plotted gold price’s reaction to the NFP print at 15 minutes, one hour and four hours intervals after the release. Then, we compared the gold price reaction to the deviation between the actual NFP release result and the expected result.

We used the FXStreet Economic Calendar for data on deviation as it assigns a deviation point to each macroeconomic data release to show how big the divergence was between the actual print and the market consensus. For instance, the August (2021) NFP data missed the market expectation of 750,000 by a wide margin and the deviation was -1.49. On the other hand, February’s (2021) NFP print of 536,000 against the market expectation of 182,000 was a positive surprise with the deviation posting 1.76 for that particular release. A better-than-expected NFP print is seen as a USD-positive development and vice versa.

Finally, we calculated the correlation coefficient (r) to figure out at which time frame gold had the strongest correlation with an NFP surprise. When r approaches -1, it suggests there is a significant negative correlation, while a significant positive correlation is identified when r moves toward 1. Since gold is defined as XAU/USD, an upbeat NFP reading should cause it to edge lower and point to a negative correlation.

Results

There were 14 negative and 21 positive NFP surprises in the previous 35 releases, excluding data for March 2021 and March 2023. On average, the deviation was -0.76 on disappointing prints and 1.36 on strong figures. 15 minutes after the release, gold moved up by $3.84 on average if the NFP reading fell short of market consensus. On the flip side, gold declined by $4.43 on average on positive surprises. This finding suggests that investors’ immediate reaction is likely to be slightly more significant to a stronger-than-forecast print.

The correlation coefficients we calculated for the different time frames mentioned above are not close enough to -1 to be considered significant. The strongest negative correlations are seen 15 minutes and one-hour after the releases with the r standing at around -0.53. Four hours after the release, r edges higher to -0.43.

Several factors could be coming into play to weaken gold’s inverse correlation with NFP surprises. A few hours after the NFP release on Friday, investors could look to book their profits toward the London fix, causing gold to reverse its direction after the initial reaction.

More importantly, underlying details of the jobs report, such as wage inflation, as measured by the Average Hourly Earnings, and the Labor Force Participation rate, could be having an impact on market reaction. The US Federal Reserve (Fed) clings to its data-dependent approach and the headline NFP print, combined with these other data, could drive the market pricing of the Fed's next policy action.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.